1H24 result at a glance

ING reported a 1H24 underlying NPAT modestly lower than expectations at $63.4m (BPe $65.5m) driven largely by a higher tax rate. Key operating statistics:

Operating results: Revenue of $1,642m was up +9% YOY (vs. BPe $1,606m). Underlying post-ASSB16 EBITDA of $252.1m was up +20% YOY (vs. BPe of $247.4m). On a pre-AASB16 basis, underlying EBITDAL was up +66% YOY to $138.4m (vs. BPe of $137.9m and guidance of ~$138m). Underlying NPATL of $69.3m was up +46% YOY (vs. BPe of $71.2m and guidance of ~$71m).

Cashflow and balance sheet: Lease adjusted operating cashflow of $74.8m compares to a -$9.8m outflow in 1H23. Ex-factoring an operating cashflow of $74.2m was reported and compared to a -$21.4m outflow in 1H23. Net debt (adjusted for factoring) exited at $478.7m compared to $394.7m at FY23 and $447.3m at 1H23 and incorporates $82.2m of acquisition funding.

Outlook: There is no formal FY24e earnings guidance. Outlook comments include: (1) earnings in 2H24 are expected to be below 1H24 levels given seasonality. This is unchanged from previous guidance; (2) Feed costs stabilised in 1H24 and anticipated to be of some benefit in FY25e; (3) Consumers are shifting to in-home dining, resulting in a channel shift to retail; and (3) S,G&A costs to be higher than FY23.

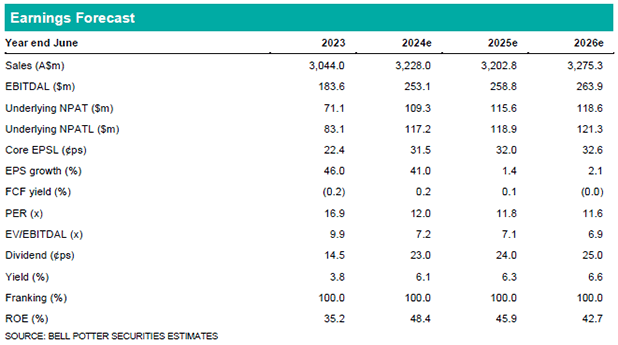

Following the result, we have downgraded EBITDAL by -3% in FY24e, -2% in FY25e and -2% in FY26e. NPATL is downgraded by -12% in FY24e, -12% in FY25e and -12% in FY26e and includes removal of expected R&D tax offsets. Our target price is now $4.35ps (prev. $4.90ps).

Investment view: Buy rating unchanged

We recently upgraded ING on a view that it is a second derivative exposure to improved winter cropping prospects with weaker feed cost drivers already becoming visible for FY25e. While the reaction to today’s outlook statement (which is essentially unchanged relative to Oct’23) was aggressive, the overall dynamic that we saw emerging remains unchanged.