FY21: $8.65bn cash NPAT, 200cps final dividend

The bank’s FY21 results are as follows: (1) statutory NPAT $8.84bn (BP $9.52bn); (2) cash NPAT (including discontinued operations and one-offs) $8.80bn (BP $8.51bn); (3) cash EPS (including discontinued operations and one-offs) 497¢ (BP 480¢); (4) cash NPAT (continuing operations) $8.65bn (BP $8.51bn); (5) cash EPS (continuing operations) 489¢ (BP 480¢); (6) final dividend 200¢ (BP 184¢) fully franked (payout ratio 72% in FY21, 73% in FY20); (7) ROE (continuing operations) 11.5% (BP 11.4%); (8) NIM (continuing operations) 2.03% (BP 2.02%); (9) loan impairment expense (LIE) $0.55bn/7bp GLA (BP $2.52bn/33bp); and (10) CET1 ratio 13.1% (BP 12.8%).

CBA’s $8.65bn cash NPAT (continuing operations) was 20% pcp higher mainly due to the recovery from COVID-19. This has been another solid result despite the expected pandemic impacts and ongoing lingering uncertainty in operating conditions. Again (and also looking past the pandemic noise), there were more positives, i.e. strong core volume growth, overall net interest income, other income, asset quality, capital, funding and liquidity – than negatives, i.e. NIM and operating expenses (perhaps for now) – in the result. Things appear to be settling down with metrics now closer between the two most recent halves (i.e. magnitude of operating income and loan impairment expense).

Price target upgraded to $118.00, back to Buy

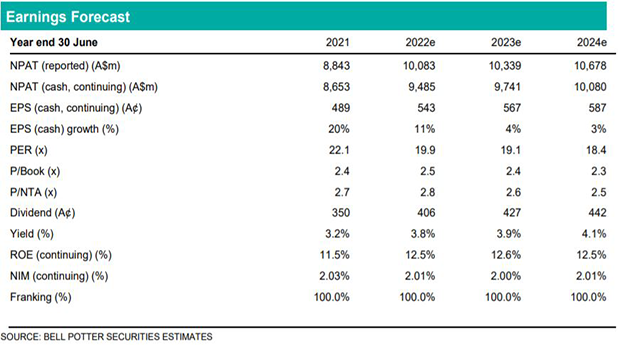

The main changes to our cash NPAT (continuing) projections relate to higher noninterest income (mainly higher card fees, fee waivers and removal of wealth contributions) as well as a still lower LIE charge in FY22 and beyond. Given these, cash NPAT is now 2% higher in FY22, FY23 and FY24. We have also matched the statutory and cash dividend payout ratios as follows: FY22 75%; FY23 75%; and FY24 75%. As a result, we have increased the valuation and price target by $13.00 to $118.00 per share and this includes adding the value impact of higher excess CET1 capital. CBA’s target share price has done well in the past three months and up by more than 25% in absolute terms. The rating is now back to a Buy.