Scenesse growth, profits expected to continue

Clinuvel (CUV) is one of very few ASX-listed biopharma companies directly commercialising novel pharmaceuticals across the US and EU in a highly profitable manner. Clinuvel distributes Scenesse, the only approved treatment for patients suffering from a rare inherited disease called erythropoietic protoporphyria (EPP). Sales of Scenesse have grown at a 3-year CAGR of 34% to A$78m in FY23. Clinuvel’s direct distribution model has resulted in seven consecutive years of profitability, with an EBIT margin between 52-53% over the last three financial years. With no alternative EPP treatments expected for at least another three years, revenue growth and high margins are expected to continue in the near-term.

Diversification beyond EPP

Clinuvel is conducting a range of pharmaceutical R&D activities and new product launches to diversify its commercial opportunities beyond EPP, including: (1) expanding the approved indications of Scenesse, such as in vitiligo, XP, VP and stroke; (2) developing additional melanocortin pharmaceuticals, such as the generic drug Neuracthel; and (3) launching a range of topical ‘PhotoCosmetic’ consumer products over the next 2-3 years.

Investment view: Initiate with a BUY; PT $24.00

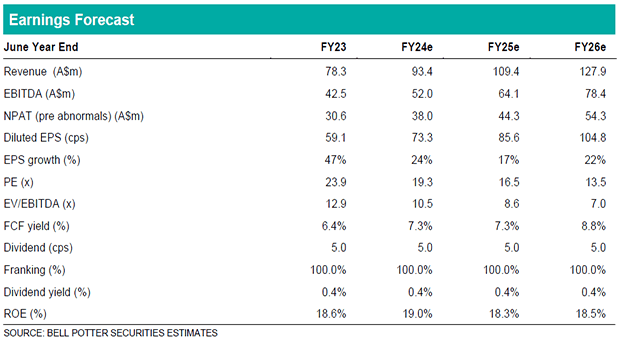

Our valuation is based on a 75:25 weighted average of (1) risk-adjusted DCF and (2) EV/EBITDA multiple analysis. We expect continued free cash flow growth in the nearterm without any competition in EPP for at least three years. Clinuvel has multiple development streams ongoing to drive medium to long-term growth, for which we expect approval of Scenesse in vitiligo (~FY28) and launch of Neuracthel (~FY27) to be the largest potential growth drivers.

Based on our DCF forecast, the current CUV share price ascribes only a modest ~$50m in value to Clinuvel beyond the EPP franchise.