Strategic acquisition in Victoria

Eagers announced it has entered into a non-binding agreement to acquire a portfolio of dealerships and key strategic properties located across Melbourne and the Mornington region of Victoria from a group of companies associated with Nick Politis. The total purchase price for the dealerships and three properties is $245m comprising of $111m in goodwill, $100m for the properties and $34m of net assets. The dealerships generate annual turnover of c.$1.0bn so, after stripping out the value of the properties, the purchase price equates to approximately 0.13x sales. The return on sales for the combined dealerships was not disclosed but if we assume an industry standard margin of around 3.0% – which is below the Eagers margin of around 4.5% – then the purchase price equates to around 4.5x (which is slightly below the 5x Eagers paid for the ACT dealerships from VFM Motors last year). The acquisition is subject to customary conditions as well as shareholder approval with a General Meeting expected to be held in early 2024.

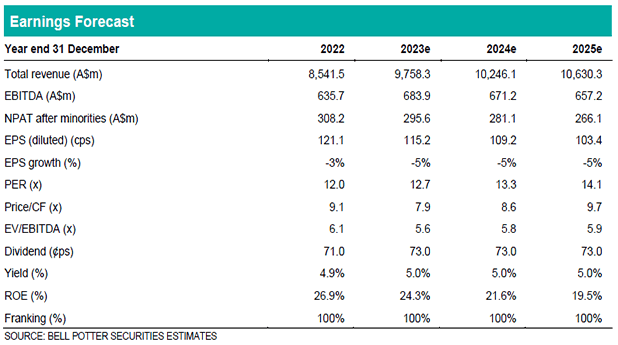

EPS accretion of 3 and 6% if acquisition proceeds

We make no change to our forecasts at this stage given the acquisition is subject to various conditions and shareholder approval. If it does proceed, however, there would be no impact on our 2023 forecasts – given the acquisition will not occur till 2024 – and EPS upgrades of approximately 3% and 6% in 2024 and 2025. Note these upgrades assume the acquisition occurs at the end of February – so 10 months contribution in 2024 – and a flat margin of 3.0% in 2024 but an improvement to 3.5% in 2025.

Investment view: PT up 2% to $15.50, Maintain HOLD

If the acquisition proceeds then the forecast EPS accretion of 3% and 6% in 2024 and 2025 suggests there is this sort of upside to our price target all else being equal. We therefore choose to raise our PT by 2% to $15.50 given the likelihood of the acquisition proceeding with some likely further upside of another 2-3% if and when the transaction occurs. At this updated PT the total expected return is still <15% so we maintain our HOLD recommendation.