September quarter 2023 preliminary update

AIS has reported preliminary September quarter 2023 production results from its four operations. Overall, we consider that AIS beat our forecasts for the quarter as follows: Tritton was slightly (6%) below our forecast at 5.2kt Cu (BPe 5.5kt Cu). Tritton has for the second consecutive quarter maintained higher grades and a production run-rate +20ktpa Cu. Cracow was marginally (2%) above our forecast at 12.7koz Au (BPe 12.5koz Au). Mt Colin (Nth Qld) beat our forecast (by 5%) at 2.4kt Cu (BPe 2.25kt Cu). Jaguar (now on care and maintenance) had a strong finish at over double our zinc production forecast. It produced 3.1kt Zn (BPe 1.4kt Zn), 0.6kt Cu (BPe 0.3kt Cu), 0.4koz Au (BPe 0.2koz Au) and 84koz Ag (BPe 38koz Ag. All operations are tracking within or above FY24 production guidance ranges. Costs are yet to be released.

First goal for FY24 kicked

This is the strongest start to a financial year AIS has had for some time. While positive the market will, in our view, wait to see improved operating costs (yet to be reported), cash addition to the balance sheet that confirms improving operational performance and debt service capacity, plus another good quarter of delivery vs guidance. On our estimates costs will have improved qoq and AIS has likely added a modest amount of cash. We expect positive operational cash flows have been partially offset by CAPEX and care and maintenance costs. A key opportunity for AIS is to refinance the high cost Soul Pattinson debt facility. In our view this would be a further positive catalyst.

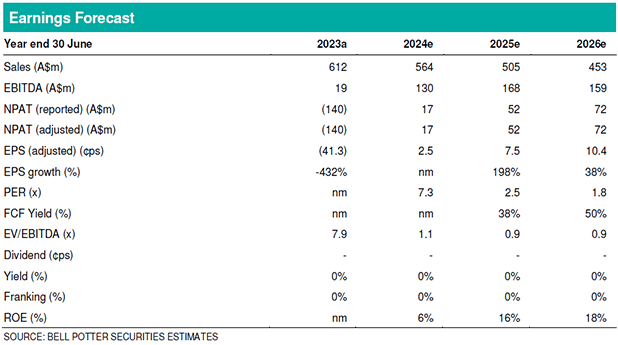

Investment thesis – Buy, TP$0.30/sh (from Buy, $0.29/sh)

EPS changes in this report are: FY24: +4%, FY25: -1%, FY26: 0%. AIS is a copper dominant producer with all assets in Australia. Its near-term outlook remains highly leveraged to increasing copper grades at the Tritton copper mine, where high grade ore sources have commenced production and exploration success is likely to sustain it. While we forecast strengthening operational cash flows, capital constraints and debt service requirements look likely to limit growth opportunities in the near term. Our target price lifts 4% to $0.30/sh and we retain our Buy recommendation.