Company background

Clean Seas Seafood Ltd (CSS) was formed by The Stehr Group in 2000 and publicly listed in 2005. The initial strategy of CSS was to propagate and grow Southern Bluefin Tuna, as well as other species including Yellowtail Kingfish. In 2012 CSS pivoted away from Tuna and began to focus on its Kingfish operations. Today CSS is a vertically integrated Kingfish producer operating hatcheries, farming and processing facilities, with lease capacity in place to support growth to ~10,000t.

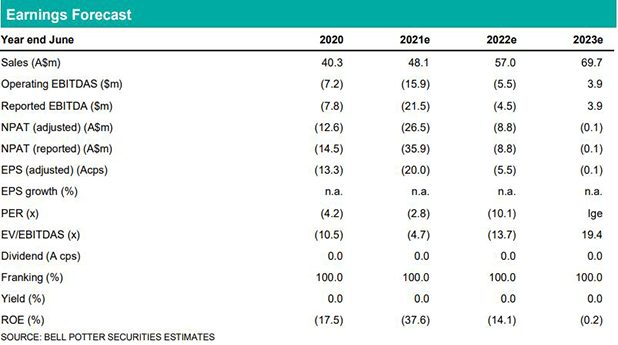

COVID reversal

Supply chain disruptions during the COVID-19 pandemic resulted in both volume headwinds (down -29% YOY in 2H20), weakness in realised selling prices (down from $17.00-17.50/Kg in 1H19-1H20 to $15.40-15.60/Kg in 2H20-1H21) as channels pivoted, and an elevated cost structure (inventory carry costs). As supply chains are re-established and biomass is cleared, we would expect these headwinds to reverse.

Investment view: Initiate coverage with Buy, Speculative risk

We initiate coverage with a Buy, Speculative risk rating and a valuation of $0.80ps. CSS provides investors with operating leverage to a re-opening in global foodservice channels resulting in the combination of stronger sales volumes, higher selling prices, and a downdraft in COGS. A resumption of historical growth rates, at pre-COVID cost and revenue points, then provides a pathway to profitability. Valuation looks undemanding compared to Oslo listed, The Kingfish Company, which is three times CSS’s market value, despite CSS having a materially larger sales and biomass base.

History of growth

Leading up to COVID-19, CSS had achieved compound growth in sales volumes of +20% pa since FY15, whilst sustaining high selling prices. CSS has biomass in place to support growth towards 4,000-5,000t, which would look a reasonable near term sales target, with a resumption of historical growth trends and following the establishment of new channels to market.