Strong FY21 result – ahead BPe, plus resilient trading update

CCX has release unaudited FY21 headline numbers plus a trading update, as follows:

- FY21 sales of $258m up 32.9% on pcp. Comparable sales up 31.6% vs pcp.

- FY21 underlying EBITDA (pre-AASB16) is expected to be $42.0-$42.5m, circa 9% ahead BPe $38.8m, and representing 58-60% growth on FY20.

- Trading in 1H22-to-date has “exceeded budget”, with strong US and UK trading outweighing impact of temporary store closures due to lockdowns in Australia.

- Net cash balance of A$71.5m as at 27 June 2021 (pre funding of Navabi, below).

Acquisition of Navabi provides foothold in European market

CCX also announced it has acquired JPC United GmbH (“Navabi”), as follows:

- Established in 2009, Navabi is an online marketplace selling third-party women’s plus-size brands. Navabi has also developed its own brands exclusively sold on the marketplace, which have grown to become the majority of sales.

- Multiple Navabi websites across Europe incl. Germany (primary), France and UK. Materially strengthens CCX’s foothold in the €40b European plus-size market.

- Navabi’s websites had 5.8m visits in 2020 generating €10.4m (A$16.6m) in sales. Pre-pandemic, website traffic exceeded 10m visits. Whilst Navabi has traded profitably in 2021, traffic and revenue have not recovered to pre-pandemic levels. This suggests material sales upside opportunity as European markets reopen.

- Payment of €6.0m (A$9.6m) in cash, implying EV/sales ~0.6x. Inventory position is depleted and will be rebuilt to more commercial levels over the next 6 months.

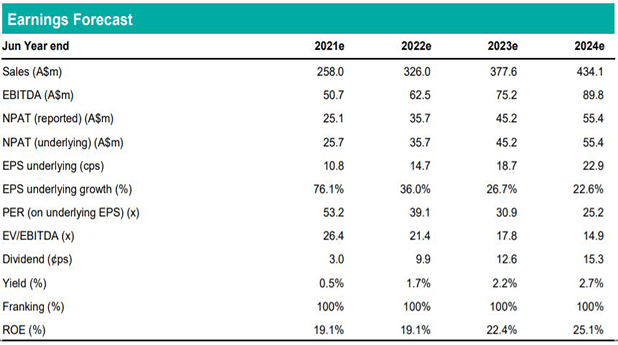

Earnings changes & Investment View: Retain Buy, PT $6.60

We have updated our forecasts for the FY21 result and acquisition, and rolled forward our model. Net effect is FY21e-FY24e EPS upgrades of 9.4%/2.5%/8.4%/11.9% & our PT increases to $6.60 (previously $4.90). We retain our Buy rating based on CCX’s: significant growth prospects in key offshore markets (with the company’s acquisitive and organic growth strategy proving highly successful); flexible business model; ample funding headroom; favourable industry tailwinds; and strong management team.