Welcome Abroad

ASIC Class Order [CO 13/721] (the Class Order) provides regulatory relief for Responsible Entities of an Exchange Traded Fund who limit withdrawals from a fund to Authorised Participants, resulting in non-compliance with the Corporations Act 2001 (the Act) through unequal treatment of members belonging to the same class. ASIC has now made ASIC Corporations (Amendment) Instrument 2021/299 to modify the Class Order which would see the removal of a regulatory barrier to entry for off-shore market-making entities seeking to participate in the Australian ETF market. The amendment means that Authorised Participants (APs) are nolonger required to identify as an Australian resident for tax purposes. ASIC formed the view that restricting entities to this category was unnecessary for consumer protection or market integrity reasons, instead finding that this delineation may lead to suboptimal outcomes for retail investors trading on the secondary market, particularly due to wider bid/ask spreads as a result of insufficient competition. We view this as a positive advancement for the industry, with lower market share dominance of APs foreseeably driving a reduction in investor transaction costs.

Figure 1 – ETF market structure

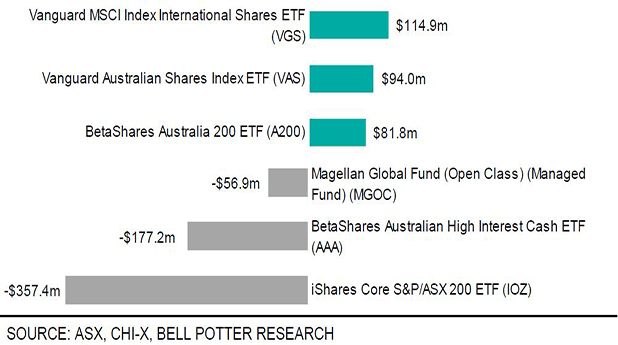

Figure 2 – Top ETF flows for June 2021

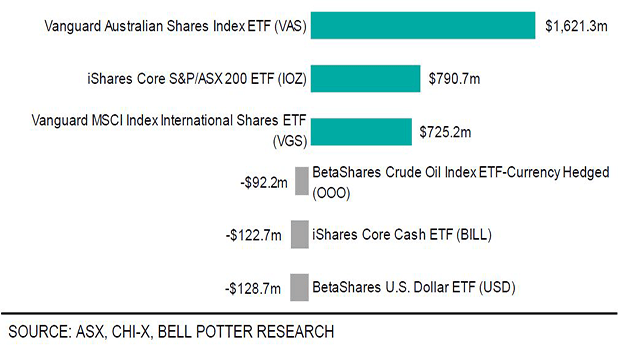

Figure 3 – Top ETF flows for 12 months ending June 2021

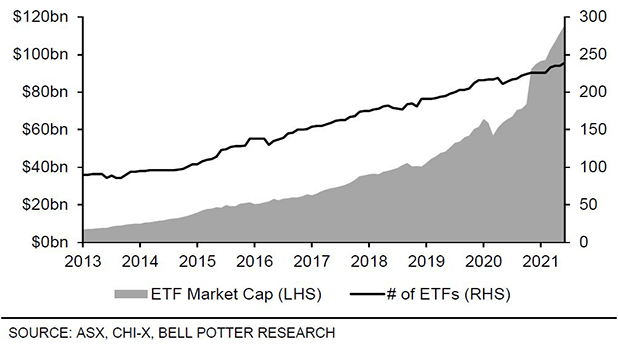

Figure 4 – ETF market size

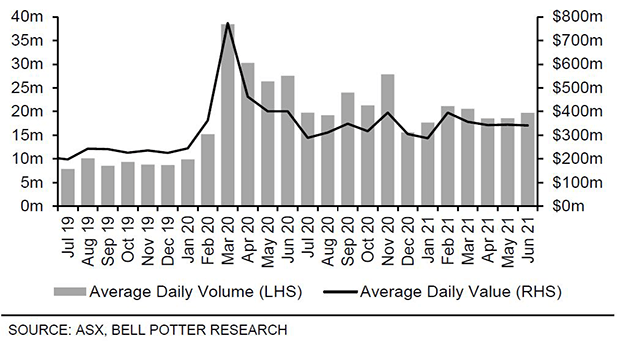

Figure 5 – Average daily volume and value