Robust FY21 result, shipping delays raises near-term risks

BRG announced underlying FY21 EBIT of $136.4m, up 24.1% YoY (on restated basis) and in line with company guidance. The key result takeaways include:

- Strong revenue growth throughout FY21: BRG’s key Global Product segment achieved 37.0% constant currency revenue growth, with all regions contributing strongly. This includes the Americas +27.6%, EMEA +58.4% and APAC +37.4%. Increased consumer demand driven by work-from-home, coupled with successful geographic expansion, offset the impact of intermittent supply challenges.

- International rollout on track: Despite covid impacts, BRG’s international rollout continued to progress to plan. The material lift in EMEA revenue reflects strong growth in the UK throughout the year, traction in Germany/Austria/Benelux/Switzerland, & ramp-up in Spain/France (launched in FY20/1Q21). In 4Q21, BRG also launched in Portugal/Italy, while in the Americas, BRG launched in Mexico.

- Although more challenges ahead, esp. due to shipping delays: The key challenges are: 1) inventory constraints due to supply chain delays (end-FY21 inventory ~$80m below target); 2) supplier chain cost pressures/parts challenges; and 3) the potential transitional demand outlook as consumers begin to spend on services (in those countries opening up). Levers to counter these challenges include: 1) taking price increases where appropriate (= gross margin cushion); & 2) costs levers (= flex on CODB/sales), noting the FY21 EBIT result absorbed $49m of increased investment. Furthermore, is the potential reversal of doubtful debt provisioning (~$8.4m off 1H21 EBIT), although the timing of this is uncertain.

- Net cash of $129.9m, although a significant rebuild in working capital is planned.

Earnings changes / Investment View: Retain Hold, PT $30.50

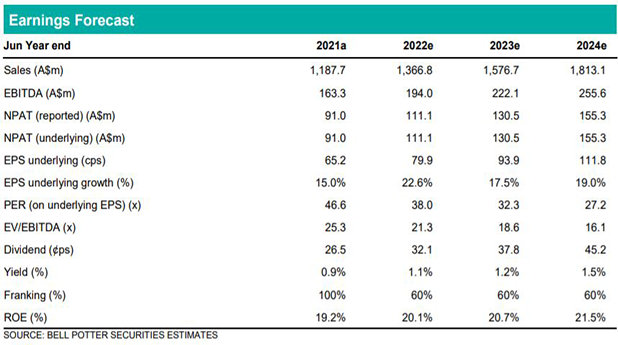

Given supply chain risks and a potential transitional demand outlook, we have lowered our growth forecasts. Net effect is our FY22-FY24 EPS decrease by -2.8%/-4.0/-7.5%. Partially offset by model roll forward, our PT decreases to $30.50 (previously $32.25). While we continue to have a positive view on BRG’s long-term growth prospects, we are mindful of the near-term macro risks and BRG’s valuation. Hold rating retained.