Strong 3Q21 anticipated

ANZ should expect these to be the same on 18 August 2021: 1) statutory NPAT ~$1.3bn; 2) cash profit (continuing) ~$1.3bn; and 3) cash profit (continuing and exlarge notable items) ~$1.3bn. This is based on almost unchanged banking income (lower net interest income and higher other banking income), further improvement in operating expenses (costs excluding large and notable items again well-managed with the bulk in productivity/modernisation savings), slight credit impairment charge (as opposed to a benefit in 1H21 due to normalisation) and effective tax rate of 30%.

Capital return

ANZ announced a capital management update this week signalling its intention to buy back $1.5bn shares on market. There was also the promise of further capital to be returned given its position, but only if all balanced and prudent outcomes are satisfied. As it is, ANZ will return a modest amount targeting around 35bp (Level 2 and Level 1 CET1 ratios as at 31 March 2021 are 12.4% and 12.2% respectively) that would still place the bank comfortably ahead of the capital requirement of 10.5%. This theoretically means the bank can also pay at least another $2.5bn by 2022. This would also bring the CET1 ratio to around 11.4-11.5%, suggesting the bank can still enjoy a buffer of around 1.0% over APRA’s minimum capital requirement

Price target increased to $30.00, Buy rating unchanged

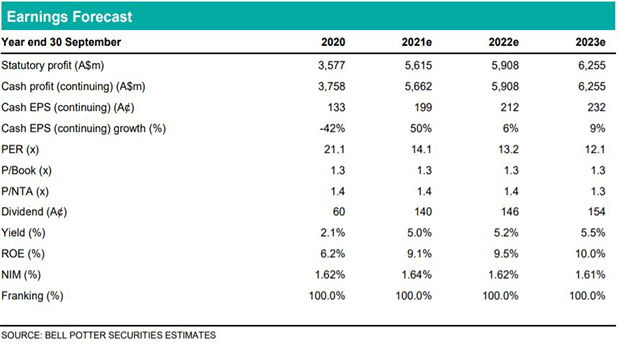

We look at ANZ’s outcomes in two sections. The first lies is changes to projections leading up to but not including the $1.5bn capital return, while the second includes the capital return of $1.5bn in FY21 and $2.5bn in FY22. Assuming no difference in earnings capacity, the only real changes lie in: 1) cash EPS (continuing) (FY21 0cps; FY22 5cps; FY23 12cps; and FY24 12cps); and 2) cash ROE (continuing) (FY21 0.0%; FY22 +0.3%; FY23 +0.5%; and FY24 +0.5%). The price target is increased by 22% to $30.00 (previously $24.50), mainly from the effects of the first section, while ANZ’s Buy rating is maintained.