Strong underlying result on Galaxy contribution

AKE reported underlying 1H FY22 EBITDA of US$98m (BP est. US$83m) and NPAT of US$57m (BP est. US$44m). Reported 1H FY22 NPAT was US$13m after nonoperating adjustments mostly relating to the Galaxy acquisition, inventory mark-tomarkets and revalued tax losses. The consolidated result included performance from the Galaxy assets from the merger date (25 August 2021), with EBITDA contributions of US$35m from Olaroz and US$71m from Mt Cattlin. As expected, no dividend was declared. At 31 December 2022, AKE had cash of US$450m, borrowings of US$330m and leases of US$47m giving a net cash position of US$73m.

Lithium pricing continues to improve

AKE now expect 2H FY22 lithium carbonate pricing to average US$25,000/t (previously US$20,000/t) and maintained an expected March 2022 quarterly spodumene price of US$2,500/t. As previously reported, AKE’s Olaroz sales are now priced on a shorter term basis while Mt Cattlin spodumene sales are set quarterly on a per cargo basis with reference to spot spodumene prices. AKE therefore will see record high lithium prices flow through to earnings until at least until at least 2H 2022.

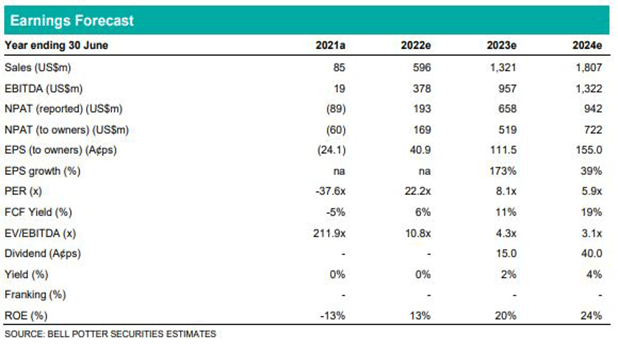

EPS changes in this report mostly reflect higher expected lithium commodity price realisation: FY22 +11%; FY23 +13%; and FY24 +6%.

Investment thesis: Buy, TP$18.05/sh (previously $17.51/sh)

AKE is a go-to stock for multi-project exposure to lithium markets. AKE will realise significantly higher prices from 2022, driving material operating cash flow growth. Looking ahead, AKE has a portfolio of growth projects to materially lift production over the next three years. Naraha will commence conversion of primary grade lithium carbonate into 10ktpa battery grade lithium hydroxide by mid-2022. At Olaroz, an additional 25ktpa LCE capacity will be commissioned from 2H 2022, lifting capacity at this asset to over 40ktpa. Construction of Sal de Vida Stage 1 at around 11ktpa LCE has commenced for first production from 2023. In aggregate, we expect AKE’s equity share of production to lift from 33kt LCE in FY21 to over 50ktpa LCE by FY24.