AGM highlights

SHV’s recent AGM comments highlighted continued subdued almond market conditions and more elevated costs than we had previously allowed for. Key points:

Crop forecast: SHV has experienced reasonable growing conditions through the year and anticipates a crop of ~29,500t (vs. BPe of 29,200t). Harvest commenced in early Feb’22 and sizing and quality are in line with expectations.

Costs: SHV has maintained comments that lower water prices should flow through to a saving of $6-8m in FY22e. However, total growing costs on a per Kg basis are anticipated to be unchanged YOY, with inflation in crop inputs and higher expensing of lease costs. This is slightly higher than we had previously allowed.

Price: Almond prices have retreated to the lows seen a year ago, with spot market pricing based on SHV’s quality mix looking to be in the region of ~A$6.00-6.20/Kg. To date SHV has committed ~20% of the crop, with price premiums being achieved for newer larger sized crop. SHV has forward cover on the AUDUSD at 73¢ over 85% of the forecast FY22e crop.

Snowpack: Following a drier than average Jan-Feb, the Californian snowpack has receded to ~63% of normal for this time of year. If maintained this would likely prove a headwind to May’22 Californian production forecasts.

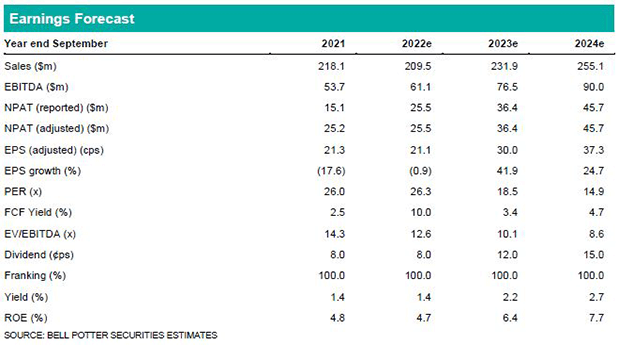

We have raised our cost estimates, while leaving our price estimate unchanged. Implicitly our forecasts assume a recovery in almond pricing as the Californian crop develops and logistics issues are resolved. Our NPAT forecasts fall -10% in FY22e, -10% in FY23e and -7% in FY24e. Our target price is reduced to $6.85ps (prev. $7.10ps) following these changes

Investment view: buy rating unchanged

There is no change to our Buy rating. SHV is trading at a level broadly consistent with its market adjusted NAV (water + land at market value) of ~$5.48ps (historical support level), with spot almond prices well below the long-term average of ~A$7.70/Kg.