Deep Dive into Afterpay + WBC Collaboration

In this report we perform a deep dive into Afterpay and WBC’s collaboration to introduce Afterpay branded savings and transaction accounts, along with budgeting tools. We see this as a step change in APT’s product offering, and as a deliberate strategy for WBC to break CBA’s stranglehold on the millennial banking market. We believe CBA should be worried, and perhaps is, which is seen with comments from their CEO Matt Comyn at the Banking Summit in November last year, who noted Afterpay as a potential threat to the banking sector over time. It perhaps also explains CBA’s over $100m investment in Afterpay’s competitor, Klarna. If APT is successful in launching white labelled WBC banking products in Australia it is likely the market will have confidence in APT rolling out a similar offering in all its jurisdictions, providing meaningful valuation upside.

Calendar of Catalysts

2021 is shaping up as a material year for APT, with the following key developments or catalysts noted below:

- APT is set to report its 1H20 result on Thursday 25th of February. We anticipate

an update on the EU launch, Canada progress, US instore, Asia expansion, and

potentially any tech collaboration developments (Tencent, WBC, Stripe, VISA,

Apple, Google, Mastercard, Worldpay); - EU Launch scheduled for March quarter;

- WBC/Afterpay product launch scheduled for June quarter; and

- Asia Expansion scheduled for September quarter.

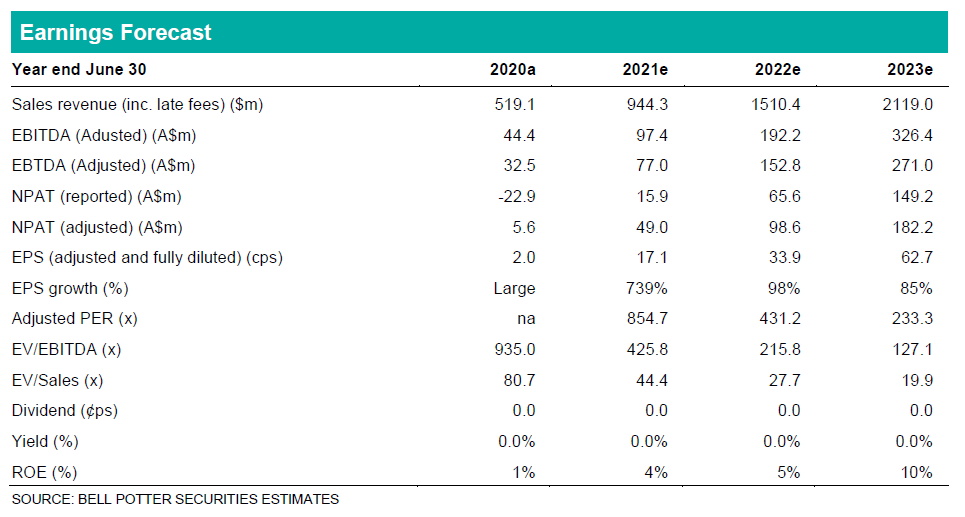

Earnings Revisions

We have made no earnings revisions as part of this report. However, we have rolled our valuation forward, primarily impacting our average customer number utilised in our LVC based valuation, and as a result of this we have a revised Price Target of $168.50 per share (previously $140.00), with our Buy recommendation remaining unchanged.