Style Trends from 2020 and Beyond

2020 has reminded investors of the need to remain vigilant in an environment of insurmountable data. Global uncertainties, tensions and sentiment can be hard to navigate on a day-to-day basis when this media is so readily accessible. The requirement remains however, the ability to discern what is materially relevant from those data points that are unseeingly obsolete. This landscape has seen the introduction of many active and smart beta style ETFs, which attempt to leverage an Investment Manager’s expertise or benefit from a foreseeable growth trend. December saw the launch of three new ETFs from Magellan Asset Management. Delivered at a low cost of 0.50% p.a., the funds provide a unique combination of active portfolio construction and systematic portfolio management (continued in report). The quasi style products may represent a looming convergence of the two with price competition. With passive funds required to indiscriminately buy as the market moves up and sell on the trajectory down, this combination may provide an expert assessment of investments with alpha generation and tailored cost minimisation.

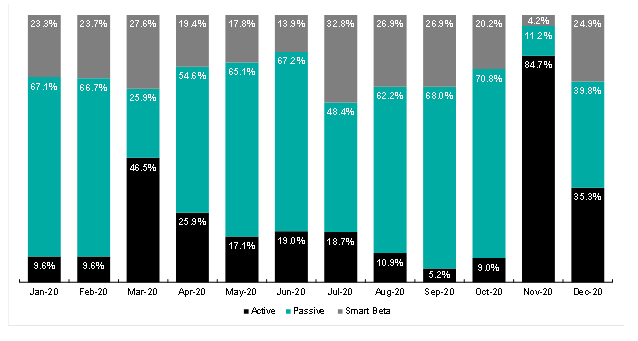

Chart 1: ETF style flows as a proportion of total monthly flows

Authored by Hayden Nicholson, ETF / LIC Specialist at Bell Potter Securities, 27 January 2021