AIS acquiring Round Oak Minerals for $234m cash and scrip

AIS has entered into a binding agreement with Washington H. Soul Pattinson (WHSP), to acquire Round Oak Minerals (ROM) for total consideration of $234m. It comprises a cash payment of $80m and a scrip component of 1,466.7m new AIS shares, to be issued at a price of $0.105/sh, valued at $154m. Following the deal, WHSP will hold approximately 30.3% of AIS. AIS is funding the cash component via a fully underwritten $117m equity raising and entitlement offer, also priced at $0.105/sh. A total of 2,582.1m new shares will be issued.

Round Oak Minerals’ assets

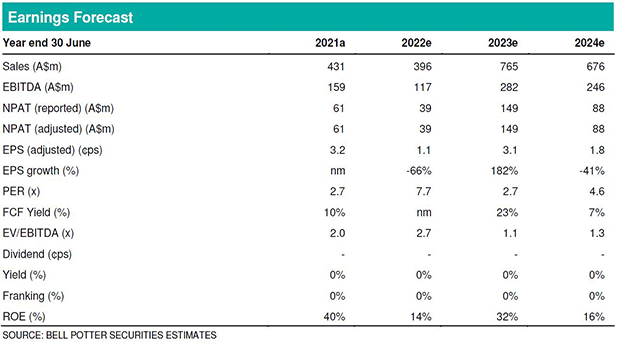

ROM is an Australian copper and zinc producer with operating mines and development assets within three of Australia’s premier base and precious metals terranes: the producing Jaguar zinc-copper mine in WA; the producing Mt Colin underground copper gold mine in QLD and the Stockman copper-zinc project in VIC. The acquisition adds production source and commodity diversity for AIS. Previously exposed only to copper and gold, we estimate that AIS’ revenues will now have 15% and 5% exposure to zinc and silver, respectively, over FY23-FY30. The Stockman development project has a planned life of +10 years which, together with Tritton, gives AIS two long-life assets which we believe create a strong foundation for growth. We also view the acquisition as good value. AIS states an FY23e EV/EBITDA multiple of 1.9x for the deal (we estimate 2.1x FY23e EBITDA), with AIS trading on similar multiples in the lead-up to the deal. If there is a downside, it is the price at which the new equity has been issued, leading to EPS dilution. However, we argue this is offset by likely multiple expansion, due to AIS’ increased scale, diversity and growth.

Investment thesis – Buy, TP$0.21/sh (from Buy, TP$0.25/sh)

Post-completion, ROM adds significant copper and zinc production, lifting AIS’ FY23 and FY24 earnings 60% and 24% respectively. In FY22, EPS is cut 45% by the dilution of the deal and with no additional earnings. In FY23 and FY24 EPS is reduced by 26% and 46%, respectively. Our NPV-based valuation is cut 16% to $0.21/sh. We retain our Buy recommendation.