Lithium product sales forecast to jump in FY23

MIN guided sales of ~225kt of lithium spodumene concentrates for FY22. In FY23, we forecast increased sales of spodumene concentrates (580kt, up 160%), and first significant sales of lithium hydroxide (~43kt). Production of lithium products is forecast to increase throughout FY23 and FY24. Growth is to come from plant expansions, reopening mines, lithium hydroxide conversion via toll-treating, and first sales of lithium hydroxide from JV owned conversion capacity in Western Australia. This growth in lithium product sales is delivered into a strong demand environment, and supportive product prices. So far in CY22, the spot 6% Li2O spodumene price is up 190%, and the spot battery grade lithium hydroxide prices is up 130%.

MIN’s lithium business to step out of the shadows

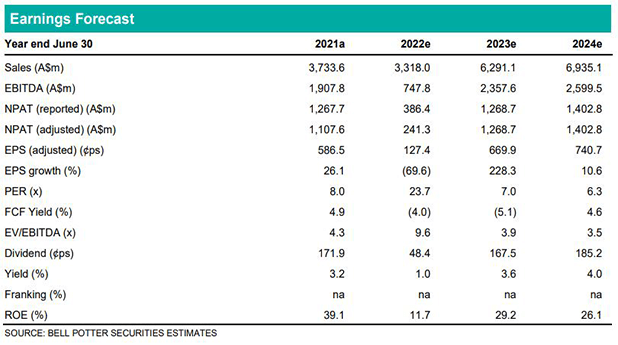

We forecast strong EBITDA growth for MIN in FY23 (>200% to $2.3 billion, from FY22e: $750m). This strong EBITDA growth is primarily a function of the growth of lithium product sales, and relatively high forecast lithium product prices. In FY21 and FY22, MIN’s share price was particularly sensitive to the performance of the iron ore business, and iron ore prices. Through FY23 and FY24, we anticipate that MIN’s share price will be increasingly supported by the lithium business, and the electrification thematic.

Investment thesis: Buy, TP$75.00/sh (from TP$70.00/sh)

MIN owns a growing portfolio of mining services and commodities businesses. Within commodities, we forecast the lithium business will start yielding significant returns from FY23. In Iron Ore, MIN is set to begin transitioning the business to a more competitive cost base with the Ashburton Project. Longer term, the embryonic Energy business has the potential to further broaden the earnings base, while providing lower carbon intensity energy security, and another service offering. EPS changes in this report include: FY22 -34%; FY23 +22%; and FY24 +95%, driven by extensive changes to our model, and updates to our commodities price forecasts.