2Q21 update: No surprises, on track vs Prospectus forecast

YFZ has delivered a positive 2Q21 update, with revenue in line with our expectations

and on track vs FY21 Prospectus forecasts.

The key highlights of the update include:

- B2C underpins strong revenue growth: 2Q21 gross revenue of $50.6m was up +26.8% vs pcp. Net revenue (after terms & discounts) of $36.7m was up +25.4% vs pcp. Growth was underpinned by B2C (gross revenue +50.6%) partially offset by B2B (gross revenue -2.5%). B2C growth driven by 49.8% increase in active

customers, while B2B continued to be impacted by reduced foot traffic due to COVID. The 2Q21 update translates into 1H21 gross revenue of $100m (+16.5% vs pcp) and net revenue of $73.6m (+15.6% vs pcp), which are in line vs BPe.

- Growth initiatives progressing to plan: A range of operational/growth initiatives were achieved during the quarter, including: 1) launch of next day deliver in NSW “resulting in a material uplift in order volumes for the period following launch”; 2) launch of the Youfoodz Subscription Service on Mobile App; 3) progress in the

B2B channel including expansion of menu range with an existing supermarket customer & roll-out of meal offering to a new convenience store customer (adding ~700 stores during the period); and 4) an initial order to, and ongoing discussions with, an airline customer around expanding menu range, and the launch of an

airline frequent flyer partnership scheduled for 3Q21. Also, the development of the new manufacturing facility is progressing as planned. YFZ has selected a preferred site and is in the process of selecting an external project manager.

- Reaffirms FY21 Prospectus forecasts: YFZ noted early results in 2H21 indicate the “momentum is continuing”. The company stated it “remains confident of achieving, and reaffirms, its FY21 Prospectus forecasts.”

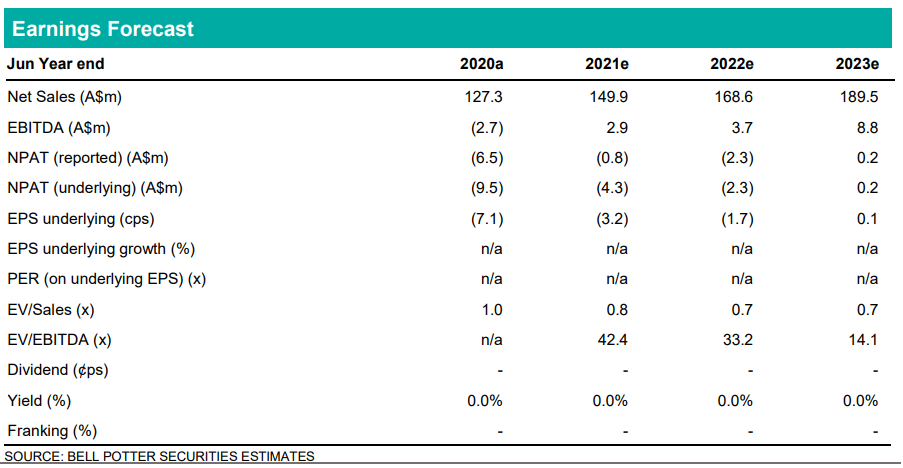

Earnings changes & Investment View: Retain Buy, PT $1.50

With the update in line with our expectations & FY21 Prospectus forecasts reaffirmed, there is no change to our forecasts and our price target remains unchanged at $1.50. Underpinned by favourable industry trends, levers at hand to grow market share (as noted above), and backed by a strong balance sheet (net cash ~$35m), we believe YFZ is well positioned to achieved continued growth and retain our Buy rating.