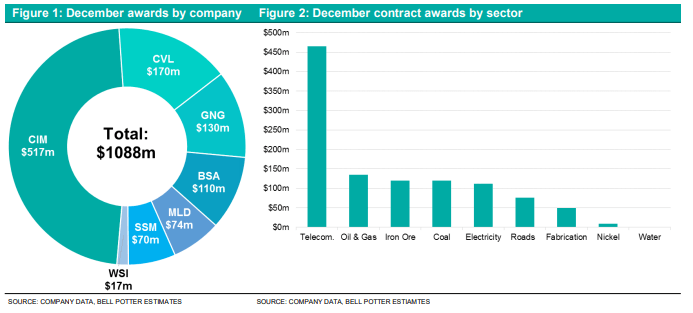

December sees big end to the year—over $1bn in awards

December saw another big month of contract awards in the BP E&C Index, with over $1bn of awards estimated to have been reached for the 3rd time in the last 5 months. This continues a trend of higher contract activity, which has rebounded sharply from the COVID lockdown induced low of $56m in April 2020.

Currency debasement, stimulus to fuel a current of activity

With a recently heightened investor focus on a possible return of inflation as a result of currency debasement and stimulus measures, the impact on the E&C sector is likely to be a strong current of project activity. Currency debasement and stimulus measures are both likely to buoy commodity prices, which have generally seen strong increases in recent months. Infrastructure investment, which was already slated to be substantial in Australia, is now likely to receive even greater emphasis in an attempt to stimulate economies.

Gives all comers a chance to flourish, M&A to continue

The heightened level of activity that is likely to result from higher commodity prices and high levels of infrastructure activity, likely means that E&C contractors will experience an opportunity to significantly grow their order books in current and upcoming halves. This will give all contractors, including those who have recently struggled, including the likes of DCG, the chance to re-establish a strong base level of revenue. SRG is another such example, with the company recently increasing its FY21 profit guidance. The positive industry demand tailwinds, and relatively easy access to capital, are likely to ensure that M&A activity remains a recurring theme in 2021. December saw continued M&A activity with DOW divesting its Open Cut Mining West business to MLD, whilst CIM completed its 50% sale of Thiess.

Beware of the flipside, particularly given strong competition

Unfortunately currency debasement and stimulus activity also has consequences, with project costs likely to also be driven higher. Whether it be wages, construction inputs such as steel, or capital equipment, cost pressures are likely to increase. This is likely to place pressure on contractors with long-term agreements, and those undertaking fixed price construction projects. These pressures remain a risk to our Buy thesis for contractors such as GR Engineering, who despite having a strong revenue outlook, may see some margin pressures.

These risks are particularly elevated given that the tendering environment appears to remain competitive. This has resulted in margins contracting across the sector in recent halves. A microcosm of a further sign of potential market competitiveness is MND’s 1H21 contract awards, which were estimated to be the weakest since 2H18, despite plenty of activity in its core markets. On the flipside, contractors such as SRG, CVL and PGX have seen significant contract awards over the past ~6-12 months. With MND seen as having a strong risk management framework and tendering discipline, it may be losing out to competitors who continue to more aggressively tender, as they seek to significantly grow their revenue.

BP E&C Index ($100 at 1 January 2020 inception): Price at 31 December 2020: $76.64, 1-month return: -3.5%, return since inception: -23.4%

Authored by Steven Anastasiou – Research Analyst at Bell Potter Securities, 28 January 2021