FY21: $5.35bn cash earnings, 60¢ final dividend

WBC’s FY21 result numbers are: 1) statutory earnings $4.63bn (BP $4.80bn); 2) statutory EPS 127¢ (BP 131¢); 3) cash earnings $5.35bn (BP $5.52bn); 4) cash EPS 146¢ (BP 151¢); 5) cash earnings ex-notable items $6.82bn (BP $6.98bn); 6) cash EPS ex-notable items 186¢ (BP 191¢); 7) fully franked final dividend 60¢ (BP 49¢); 8) cash ROE 7.6% (BP 7.8% before management buyback); 9) Group NIM 2.04% (BP 2.06%); 10) credit impairment charge -$0.59bn/-8bp GLA (BP -$0.12bn/-2bp); 11) CIR 63% (BP 63%); and 12) Level 2 CET1 ratio 12.3% (BP 11.9%).

Notable items of $1.32bn reduced the Level 2 CET1 ratio by 15bp – a small price to pay for cleaning up historical one-off items. Excluding these items, cash earnings in FY21 are higher at $6.82bn (+33% pcp, -18% hoh). On a full year basis, the rise was due to the addition of notable items and impairment charges (likewise on a hoh basis). Unfortunately, this was also tempered by lower net interest income of $16.71bn (-2% pcp, -3% hoh), mixed other income ($4.32bn, up by 22% pcp but mainly due to one off items as the hoh figure was down by 14%) and very high operating expenses of $13.28bn (+5% pcp, +22% hoh but mainly due to one off items once again), and helped only by a credit impairment benefit ($0.59bn or a large pcp change).

Price target now $26.00, maintain Hold rating

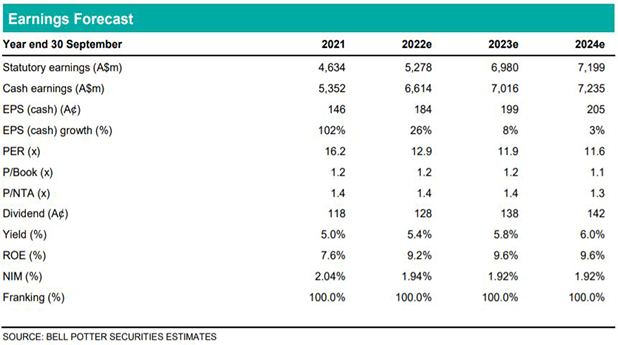

There is a downward revision of around 3% in cash earnings for the foreseeable future. While net interest income broadly remains the same, we have lowered other banking income by the same amount and further increased operating expenses by around 5% until such time where we can see real progress. There is also a change in the credit impairment charge, being lower at around 9bp in FY24e (vs. 13bp previously). Finally, we have also increased the discount rate to 10% and dividend yield to 4.25%. The price target is thus lowered by 4% to $26.00 (previously $27.10). Given a 12-month TSR of less than 15%, we maintain a Hold rating for WBC.