All cash takeover from IGO

WSA has entered into a Scheme Implementation Deed (SID) with IGO Limited (IGO, under review) under which IGO will acquire WSA for A$3.36/sh in cash, by way of a scheme of arrangement. On a fully diluted basis this implies an equity valuation of A$1,096m and represents a 35.5% premium to WSA’s undisturbed share price (prior to the announcement of a potential change of control transaction) of A$2.48. WSA’s Board has unanimously recommended the SID (in the absence of a superior proposal). Top shareholder, Perpetual Limited, which holds 14.7% of WSA, has announced its conditional support for the SID. IGO intends to fund the acquisition via a new A$900m debt facility and its existing cash reserves of A$552m. Provisionally, the SID is planned for implementation by April 2022.

Cash consideration tops our expectations

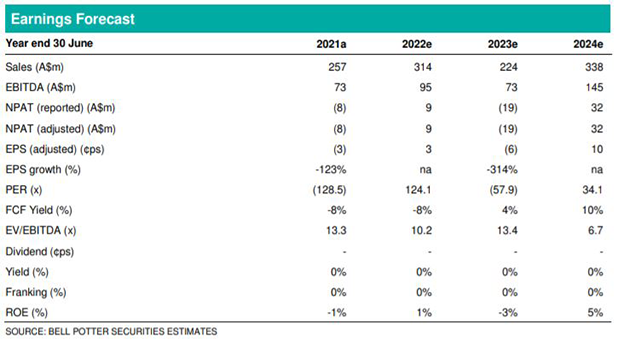

This is a fantastic result for WSA shareholders. It effectively brings forward and derisks the value of WSA’s production and development portfolio, crystallised via a cash consideration. The equity valuation of A$3.36/sh is well ahead of our previous target price of A$2.90/sh, which was inclusive of a takeover premium. Our earnings forecasts for WSA show marginal profitability or losses for FY22 and FY23 and no dividends. WSA’s prime asset, Odysseus, while progressing well towards first concentrate production by December CY22, remains exposed to scheduling, construction and cost risks. These risks are now transferred to IGO shareholders – to whom we also see no material earnings or free cash flow accretion until FY24 at the earliest. In this context we view IGO as having paid an unnecessarily high premium. Indeed, the solid strategic rationale for the deal which, in our view, delivers greater de-risking benefits to WSA shareholders, may well have justified a lower-than-benchmark premium be paid.

Investment thesis – Hold, TP$3.36/sh (was Sell, TP$2.90/sh)

We make no changes to our earnings forecasts with this update. We adjust our valuation to reflect the acquisition consideration being offered by IGO, adding a $285m premium to our underlying WSA valuation. We upgrade to a Hold recommendation.