Thanks to soaring inflation and legislation that ties select superannuation caps and thresholds to the inflation rate, many retired and soon-to-be-retired superannuation members will receive an added boost to their retirement savings. It is essentially a give with the one hand and a take with the other scenario.

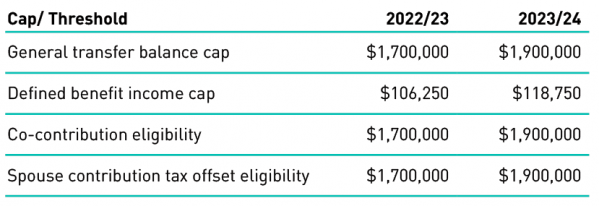

On 25 January 2022, the Australian Bureau of Statistics published the December inflation figures resulting in the indexation of the following from 1 July 2023:

Of course, the Parliament may freeze the indexation as part of its broader changes to superannuation in the May Federal Budget, however there is no commentary to suggest this will occur.

Will the contribution caps also increase?

While the general transfer balance cap increases with inflation, contribution caps increase in line with the Average Weekly Ordinary Time Earnings (AWOTE), which has not increased sufficiently to cause a jump in the concessional and non-concessional contribution caps.

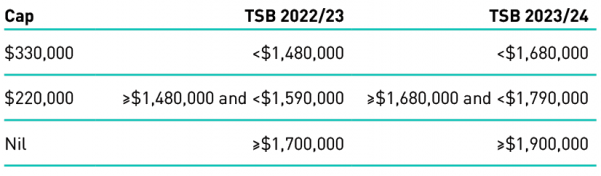

However, there is some good news for contributors. The general transfer balance cap jump will result in an increase in the non-concessional bring-forward taper thresholds. Therefore, a member looking to take advantage of the full or partial bring forward non-concessional contribution caps will be able to with a larger 30 June total superannuation balance, with the taper starting at $1,680,000 as opposed to the current $1,480,000.

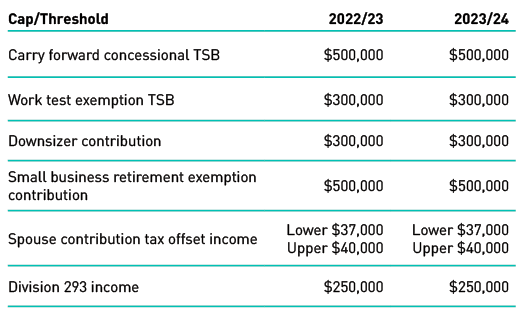

What is not indexed?

A lot remains unindexed. The direct link between inflation and the general transfer balance cap is unusual. The following caps and thresholds, among others, are hard-coded into the legislation and therefore are not indexed with inflation nor AWOTE.

Now or delay?

The general transfer balance cap indexation has grabbed headlines and made people consider whether they should wait before starting a pension or contribute now. So, the question remains − what should they do?

The answer is not a simple yes or no. Various factors around earnings need to be considered before making a decision. Some factors include one-off income, the time horizon before 30 June, the unused indexation proportion, previous and future contributions, future eligibility to contribute and the accounting method.

As usual, timing is everything when it comes to superannuation. Now is the time to seek advice. Get in touch with your Bell Potter adviser for a more detailed discussion.

LEARN MORE

Our Technical Financial Advice team, in conjunction with a Bell Potter adviser can help you create a road map to achieve your financial goals, no matter where you are today. Whether you are looking for one-off advice or ongoing advice, our team can assist.

Get in touch with us to set up a complimentary initial appointment over the phone or in person across Australia.