Outperforming the Furniture & Homewares category

We have revisited the latest furniture & homewares (F&H) category trends and thereby our TPW forecasts/valuation. Although the overall furniture & homewares category (online & offline collectively) has trended downwards since mid-1Q2023, the online channel in terms of web traffic has reverted back to growth with consecutive positive trends on a pcp basis into June/July (month to-date). We note TPW outperforming the overall online market growth together with peers such as Adairs during the past 2 months. However we note supportive comps from mid-June given the softer trading in the pcp at the start of the monetary policy tightening cycle ~12 months ago and expect the continuation of a similar pace to drive upgrades to consensus expectations.

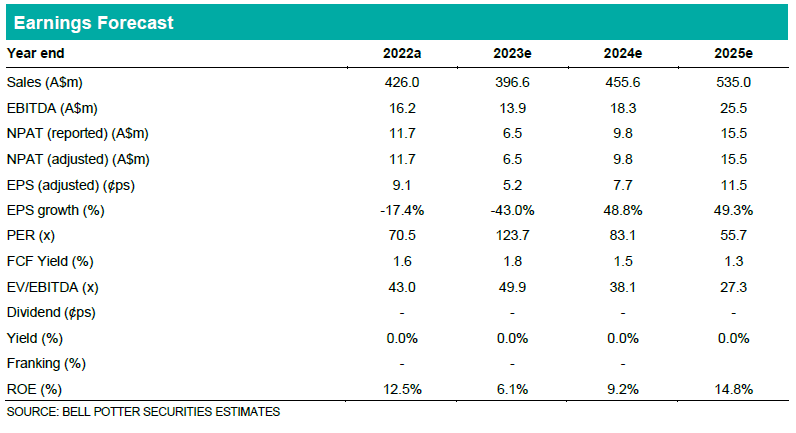

Marginal upgrades in FY24/25

While our FY23e estimates remain unchanged, we make marginal changes to our FY24/25e revenue forecasts to incorporate the current pace in TPW’s web traffic for the month of July (to-date). We remain cautious on the short term outlook and expect further easing in furniture & homewares category spend, however we note TPW’s outperformance to the industry and somewhat stronger start to FY24 which has driven our 1H24 revenue uplift. Our EBITDA margin assumptions remain the same (4.0% and 4.8% for FY24/FY25e) given the company’s focus on returning to high growth and we await guidance at the August FY result. We believe the company will be able to grow revenue in excess of $1b over the next 5 years with higher margins than pre-COVID.

Investment view: PT up 36% to $6.40, Maintain HOLD

Our PT increases 36% to $6.40/share (prev. $4.70/share) driven by the rolling of forward earnings in the DCF (up to FY33e) & relative valuation (FY25e based) and the increase in our target multiple to 22x EV/EBITDA (prev. 19x) to reflect the re-rate in the global peer group average EV/EBITDA (CY23/24 based). We have seen the average group multiple expand 16% in the past 12 months. While we believe that TPW’s longer term opportunities and ability to execute far outweighs peers, at our updated PT of $6.40 the total expected return is still <15% so we maintain our HOLD rating.