Strong final quarter results in FY23 revenue guidance beat

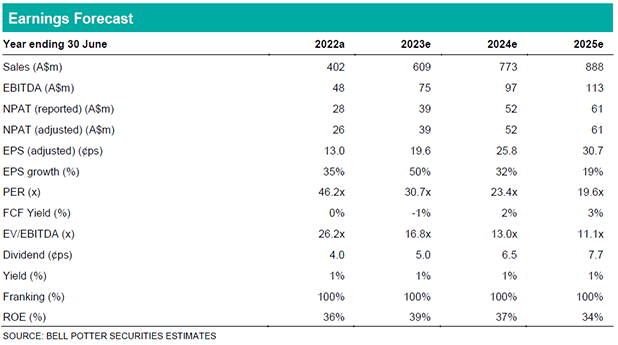

MAD reported its 12th consecutive quarter of revenue growth. Quarterly revenue of $173m resulted in FY23 revenue of $609m, in line with our expectation and MAD’s twice-upgraded full year guidance of >$580m. The seasonally strong quarter was underpinned by growth across Australian operations, reflecting robust demand for MAD’s core mechanical services and new vertical service offerings, and in North America as penetration into new US regions was executed and headcount growth in Canada continued. Quarterly EBITDA grew to $23.5m, higher than our $20.1m expectation, partly reflecting timing of contracted work scopes. FY23 EBITDA was $75.0m, ahead of our $71.6m estimate. Quarter-end net debt (excluding leases) was $42.7m, in line with the prior quarter. EPS changes in this report reflect an upward revision in our revenue growth assumptions, reduction in EBITDA margin assumptions and higher depreciation expense as a result of increased capital expenditure over FY23-25: FY23 +3%; FY24 +7%; and FY25 +15%.

All eyes on FY24 revenue & NPAT guidance

Having materially exceeded its twice-upgraded FY23 revenue guidance, management’s messaging of FY24 financial performance is now key. It is clear the FY23 financial performance exit-rate is strong, with positive momentum across Australian and North American operations to carry forward into FY24. Our outlook indicates EPS growth of 31.6% in FY24, compared with 50.3% (BPe) in FY23. At the current share price, we believe this EPS growth outlook is appropriately priced-in.

Investment thesis: Hold; TP$6.10/sh (prev. $5.10)

Our MAD earnings outlook is underpinned by ongoing expansion of the company’s core and new service offerings across its mature Australian operations and large growth markets, including the United States and Canadian mining and energy sectors. We believe MAD’s valuation premium of 107% (FY24 EV / EBITDA) against Mining Services sector peers justifies our high-growth earnings outlook; our Hold recommendation recognises MAD is fairly valued.