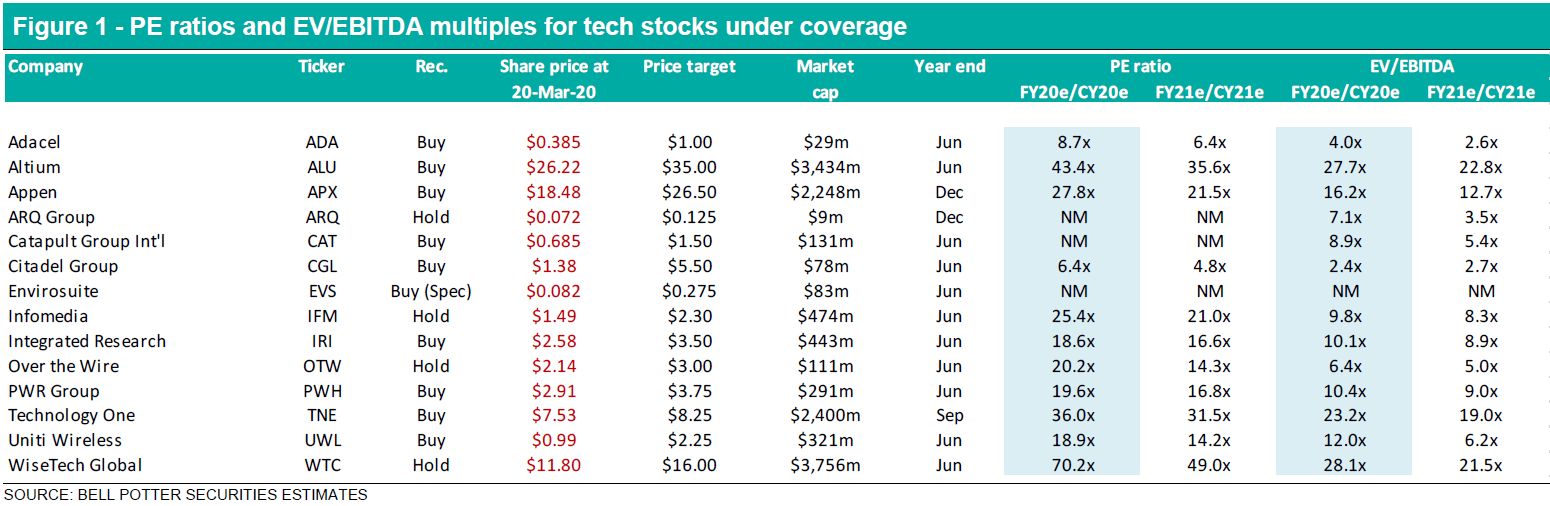

Our updated key picks in the tech sector post last month’s reporting season and the recent sell-off in the market are:

- Appen (APX): Remains our number one pick with the stock now trading on an attractive CY20 PE ratio of c.28x and the potential of the company upgrading its 2019 guidance at some stage this year;

- Uniti Group (UWL): A new key pick given the stock is now trading on an attractive FY21 EV/EBITDA multiple of c.6x and there is also reasonable downside protection to our forecasts given the high level of recurring revenue (c.90%) and all operations are in Australia; and

- Citadel Group (CGL): Remains our number three pick with the stock now trading on a very attractive FY21 EV/EBITDA multiple of c.3x and there is also reasonable downside protection to our forecasts with the recurring nature of contracts in both the Australian and soon to be acquired UK businesses.

The one change we have made to our key picks since we updated them in January is to remove Catapult Group (CAT) as our number two pick and replace this with UWL. The key reason for the change is we see some downside risk to our CAT forecasts given the disruption to global sporting leagues and competitions from coronavirus and also Q4 is typically the strongest sales quarter for the company. Conversely we see little downside risk to our UWL forecasts and little potential impact from coronavirus.

Updated key sells: None

We currently have no SELL recommendations in the tech sector. In the last couple of months we have had a SELL on WiseTech Global (WTC) and ARQ Group (ARQ) but we upgraded the recommendations on both to HOLD after the share prices fell below our price targets.

Appen (APX)

Appen looks well positioned to deliver another strong result in 2020 and to not be materially impacted by coronavirus. There is also the prospect of an upgrade to the guidance at some stage. We therefore see the stock as attractive at the current 2020 PE ratio of c.28x which is towards the lower end of the range it has traded on recently.

Uniti Group (UWL)

The large fall in the share price is unjustified in our view given the high level of recurring revenue and likely minimal impact from coronavirus. The FY21 EV/EBITDA multiple of c.6x looks very attractive given the defensive nature of the earnings as well as the anticipated good growth based on contracted ports and ports in construction as well as a healthy pipeline. The Balance Sheet is also strong with net cash of c.$34m at 20 March and this positions the company well to make further acquisitions without necessarily having to do another capital raising.

Citadel Group (CGL)

The share price fall looks well overdone given the core business is performing well, the acquisition makes sense and is a resilient business and the debt looks well manageable. The FY21 EV/EBITDA multiple of c.3x looks too cheap for a stock with defensive attributes (e.g. 50% recurring revenue, long term customers) and which is now predominantly software based with 60% of GP coming from this area.

LEARN MORE

If you’re interested in learning about these investment opportunities in the context of your portfolio, get in touch with your Bell Potter adviser. Alternatively, call 1300 023 557 to organise an obligation free discussion with one of our experienced advisers.