Expecting another solid result

Technology One is scheduled to report its 1HFY22 result on Tuesday, 24th May and we anticipate a solid result with forecast low double digit revenue and PBT growth. In our view, however, the key highlight will be the level of SaaS ARR growth which we expect to be strong given the level of SaaS flips are likely to be accelerating. We forecast SaaS ARR growth of 38% to c.$215m and, furthermore, forecast total ARR growth of 18% to c.$275m. One offsetting impact, however, of the expected accelerating SaaS flips is the level of on premise initial licence fees is likely to fall materially – we forecast a 44% fall to $2.0m – and while this is a headwind for earnings we believe it is positive overall that these licence fees are rapidly diminishing. We also expect Technology One to provide FY22 guidance at the release of the interim result and expect the usual 10-15% growth in PBT with the likelihood this will be towards the upper end despite the rapid decline of on premise initial licence fees.

No change in forecasts

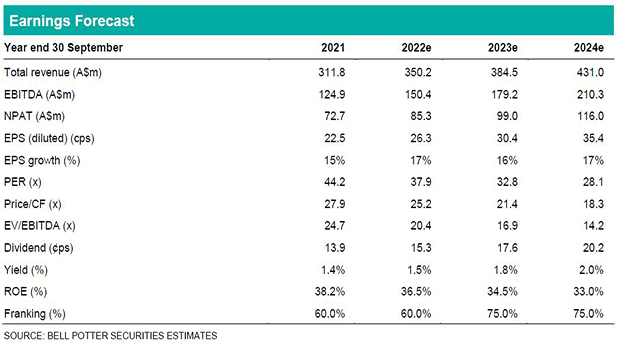

There is no change in our forecasts and we wait for the release of the 1HFY22 result before looking to reassess. We already forecast strong PBT growth of 16% in FY22 which is slightly above the top end of the 10-15% growth we expect the company to provide as FY22 guidance. The key swing factor this year is likely to be the level of on premise initial licence fees and if, for instance, Technology One is still able to generate a result towards the top end of the usual 10-15% growth range despite a material fall in these licence fees then this will further increase the quality of the result.

Investment view: PT down 11% to $12.50, Maintain BUY

While there is no change in our forecasts we have updated each valuation used in the determination of our price target for market movements and time creep. There are no changes in the key assumptions we apply which are a 15% discount in the relative valuations and an 8.5% WACC and 5.0% terminal growth rate in the DCF. The net result is an 11% decrease in our PT to $12.50 which has all been driven by a reduction in the relative valuations. We maintain our BUY recommendation.