FY22e Earnings guidance

UMG has provided a FY22e trading update with the key points below:

FY22e EBITDA guidance: FY22e EBITDA guidance of $115-140m, ex-SaaS costs, which are expected to now be $13m (prev. $10m) in FY22e. On a LFL basis, FY22e EBITDA guidance of $103-128m compares to our previous $140m forecast. Drivers of the deviation are: (1) elevated barley procurement costs lifting from $8-10m to $20-25m with Canadian crop quality issues the major new deviation; (2) delayed sales due to supply chain disruption of $8m; (3) higher input costs including energy and freight impacting EBITDA by $4m; (4) slower realisation of transformation benefits (although continuing to target $30m by FY24e); and (5) slower transition to pre-COVID mix profile, though volumes are approaching pre-COVID levels.

1H22e EBITDA guidance: 1H22e EBITDA of $57m pre-SaaS and $51m post-SaaS. This compares to our previous $59m forecast post SaaS.

Balance Sheet: Net Debt is expected to be ~3.2x EBITDA at 1H22e and at 2.5-3.0x FY22e EBITDA at year end. It is forecast to reach the target range of 2.0-2.5x EBITDA by FY23e, taking into consideration capex of ~$55-60m in FY23e.

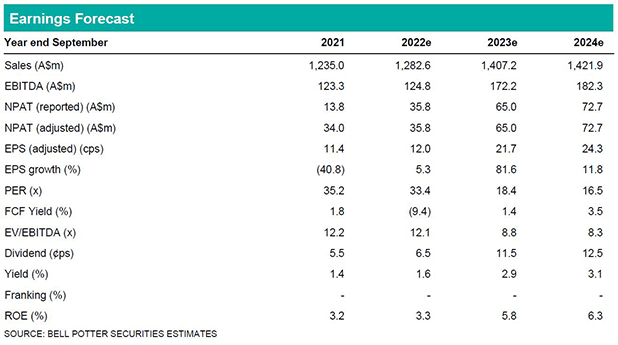

On face value FY22e EBITDA is expected to be below our previous expectations, though driven for the most part by higher supply chain and barley procurement costs (these appear one off in nature). Following the update and incorporating higher debt and debt funding rates in outward years, we have downgraded our NPAT forecasts by -23% in FY22e, -6% in FY23e and -7% in FY24e. Our target price which is predicated on long-term returns is unchanged at $4.35ps.

Investment view: Hold rating unchanged

Our Hold rating remains unchanged. FY21-22e is likely to reflect the cyclical low for UMG, however, the value equation for UMG is largely reliant on UMG demonstrating returns on UK investments ahead of UMG’s and industry peer margins and delivery against the ~$30m of targeted transformation benefits and the extent to which cost inflation proves transitory in nature.