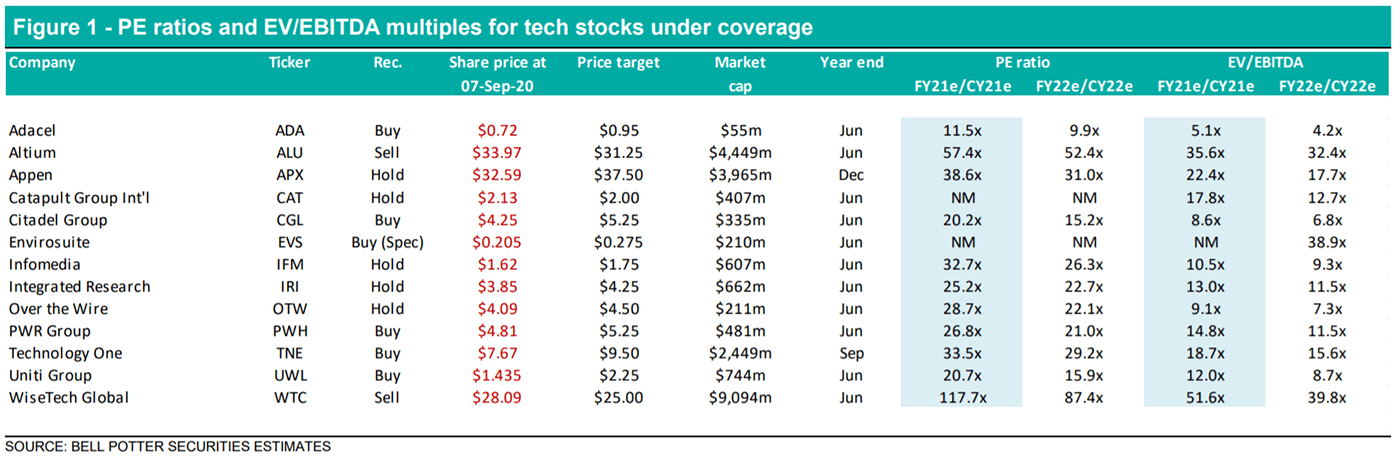

Our updated key picks in the tech sector following the recent reporting season and some changes in recommendations are:

- Uniti Group (UWL): Remains our number one pick in the sector given it looks value – FY22 EV/EBITDA <10x in first full year of Opticomm acquisition – and has the rare combination of being defensive and having good growth

- Technology One (TNE): A new key pick following the recent pullback in the share price and the stock now looking value again on an FY21 PE ratio of c.33x which in our view is attractive for a company that is successfully transitioning to SaaS; and

- Citadel Group (CGL): Another new key pick given the value we see in the stock – FY21 PE ratio of c.20x and EV/EBITDA <10x – and the positive outlook with EBITDA expected to grow from c.$38m in FY20 (pro forma) to around $44-45m in FY21 driven by a strong pipeline and synergies from the Wellbeing acquisition.

The key changes we have made to our key picks since we last updated them in early June are to remove Infomedia (IFM) and PWR Group (PWH) given the downgrade in recommendation to HOLD for the former and the strong share price performance in the latter. These have been replaced by Technology One and Citadel.

Updated key sells: WTC & ALU

Our updated key sells are now WiseTech Group (WTC) and Altium (ALU) with the only change being the addition of the latter. The SELL recommendations on both are driven by valuation rather than anything company specific and we actually have high regard for both companies. We do, however, see a lack of catalysts for each stock and the potential for relatively subdued growth in 1HFY21.

Key Picks

Uniti Group (BUY, PT $2.25)

Uniti is a key pick for the following key reasons:

- Looks value: In our view Uniti looks value on an FY22 EV/EBITDA of <10x which is the appropriate multiple to focus on given FY22 will have 12 months of Opticomm and all of the flagged $10m in synergies. That is, our forecasts assume the successful acquisition of Opticomm which is expected to be completed at the end of this month.

- Defensive with growth: Uniti has the rare combination of being defensive and having good growth. The company is defensive due to the high level of recurring revenue – c. 90% for Uniti and c.60% for Opticomm – and the low level of churn across both businesses. The growth comes from the activation of already connected premises (c.75,000 for both Uniti and Opticomm) and the continued rollout of broadband networks (c.190,000 contracted lots for both Uniti and Opticomm).

- M&A activity likely to resume: Uniti has not made an acquisition since the announcement of the proposed Opticomm acquisition in mid June but post the expected completion of this acquisition at the end of the month we believe M&A activity will likely resume. Note the leverage ratio (net debt/pro forma underlying EBITDA including synergies) post the Opticomm acquisition is only expected to be c.1.1x so in our view the company can debt fund around $50m or more of acquisitions which increases the likelihood of the acquisitions being EPS accretive.

- Easing of negative factors: Over the past few months there have a number of factors which have weighed on the Uniti share price including the large equity raising in June, the risk of a rival bidder for Opticomm and the impending issue of another 84m shares as part of the acquisition. Over the next several weeks these factors will subside and we expect this to foster a rally in the share price especially if the $90m EBITDA run-rate is updated and/or there are further EPS accretive acquisitions.

Overall view: In our view the underperformance of the Uniti share price has been driven by the factors surrounding the Opticomm acquisition and so, once the acquisition is completed, we expect the performance to significantly improve. We therefore do not see a need for catalysts to drive a re-rating in the share price though some could still be forthcoming with, for instance, an increase in the $90m EBITDA run-rate, further acquisitions and S&P/ASX 200 Index inclusion at the next rebalance.

Technology One (BUY, PT $9.50)

Technology One is a key pick for the following key reasons:

- Looking value again: In our view Technology One is looking value again post the recent pullback in the share price on an FY21 PE ratio of c.33x. We believe this represents value given the company is successfully transitioning to SaaS (i.e. close to half of its customers will be on SaaS by the end of FY20) and the large discount to other SaaS companies like WiseTech (WTC) and Xero (XRO).

- Result could be a catalyst: Technology One has a September year end and so will not report its FY20 result till mid November. The company typically has a stronger second half – largely due to the timing of renewals and weighting of the sales pipeline – and we expect this year to be no different. The delivery of both a strong 2HFY20 result and the FY20 guidance could be a catalyst for the share price and we note the stock has rallied in each of the last two years in the lead up to and post the full year result.

- Cash flow could silence the doubters: One reason for the underperformance of the Technology One share price has been a negative research report that claims the company has used various accounting tricks to artificially create growth. We do not agree with the assertions and the major flaw in our view is they fail to recognise the impact on a company switching to a SaaS delivery model. The key test of any company’s earnings is cash flow conversion and we believe the FY20 result of Technology One will have a very strong conversion rate and this will likely help reduce any concerns around earnings quality.

- Outlook improving: Earnings growth has slowed this year from the typical 10-15% to 8-12% due to some impact from COVID-19 as well as a fall in perpetual licence fees. In our view the growth will likely return to 10-15% in FY21 and beyond given the likely lesser impact from COVID-19 and the lessening impact from declining perpetual licences as these become smaller. There is also the potential for the growth to exceed 15% p.a. given the increasing operating leverage as the transition to SaaS continues.

Overall view: In our view Technology One is yet to be fully recognised as a SaaS company given <50% of its customer base is still on premise. This will likely change, however, in the short to medium term as the transition to SaaS continues and the percentage flips to >50%. Importantly the benefits of switching to SaaS (greater recurring revenue, increased operating leverage, etc.) will only really become evident when the percentage of SaaS customers is >50% and this in our view will help drive a re-rating in the multiple towards that of other SaaS companies.

Citadel Group (BUY, PT $5.25)

Citadel is a key pick for the following key reasons:

- Looks value: Citadel looks good value trading on an FY21 PE ratio of c.20x and an FY21 EV/EBITDA multiple of <10x. In our view this is cheap for a stock that now generates close to 50% of its revenue from software (or close to two thirds of its gross profit) and which will likely increase to 75% or more over the next few years. That is, Citadel is becoming more of a software than a services business.

- Key risk is now behind: In our view the key risk of a slightly disappointing FY20 result is now behind the company and indeed the underlying result was actually consistent with our expectations. Furthermore the quality of the result was good and the area of weakness – a slowdown in spend by the tertiary education sector – was understandable and also provides an area of potential upside in FY21.

- FY21 forecasts look well achievable: Our underlying FY21 EBITDA forecast of $44.4m equates to growth of 16% relative to the underlying pro forma FY20 EBITDA result of $38.4m. In our view this growth looks well achievable given the strong pipeline, the new channel partnerships, the completion of a large construction project in 1HFY21 and also the cross sell opportunity with Wellbeing customers. We also note our underlying FY21 EBITDA forecast is consistent with consensus of c.$44m.

- Potential further M&A: We expect Citadel will make further acquisitions post Wellbeing and these are all likely to be in software. Indeed the company has already made a one small acquisition since Wellbeing – eQstats in mid August – and this was in software. The current leverage ratio of around 1.5x means Citadel can debt fund more small acquisitions but is probably prevented from making a large acquisition (i.e. consideration of $25m or more) without also using equity. Note more acquisitions of software companies will further increase the percentage of revenue from software.

Overall view: Citadel is transforming from a services company with some software to now more of a software company with a residual services business. The multiple the company trades on, however, has yet to re-rate and we believe a double digit EV/EBITDA is more appropriate versus the high single digit now. The other key benefit of shifting to more of a services company is the visibility will increase – given >75% of software revenue is recurring – and this will remove one of the criticisms in the past that the company was too much of a black box. There also looks to be some potential short term catalysts with some large tenders to be decided this half and the flagged channel partnerships to be formalised.