Strong 1H21 trading update, CEO transition announced

PMV recently provided an update on trading for 1H21, with the following key highlights:

- Premier Retail 1H21 EBIT guidance (pre-AASB16) to be $221m-$233m: This is materially up between 75% and 85% on 1H20, well ahead BPe and consensus.

- 1H21 EBIT margin balloons to >28% vs 17.2% in 1H20: Outperformance vs BPe was primarily due to materially stronger than expected margins. Margins benefited from “exceptional” gross margin expansion & strong cost controls. We believe the key factors driving margin gains included: online growing to 20.4% of sales vs 13.4% in pcp (higher margin channel); Peter Alexander outperformance (higher margin brand); & opex leverage on strong cost controls incl. agreements on rent abatements. Also, PMV was eligible for JobKeeper up until end-Sept.

- Robust sales performance: For the 24 weeks to 9 January, despite significant store closures, Retail sales increased 5.0% to $716.9m. Excluding store closures, global like-for-like (LFL) sales increased 18%, with Australian LFL up 26.2%. 1H21 online sales lifted 60% vs pcp to $146.2m (or 20.4% of Just Group sales).

PMV also recently announced CEO, Mark McInnes will resign after serving a 12-month notice period. During his tenure as CEO (>10 years at completion of notice period), Mr McInnes led the implementation of a strategic review (undertaken in 2011) that has since successfully rejuvenated the Just Group business, achieving consecutive YoY growth. His departure obviously raises leadership uncertainties, although we believe this will be well managed given: the relatively long notice period; the strong senior management team within Just Group; and Solomon Lew will oversee the transition.

Downgrade to Hold on valuation, revised PT of $23.90

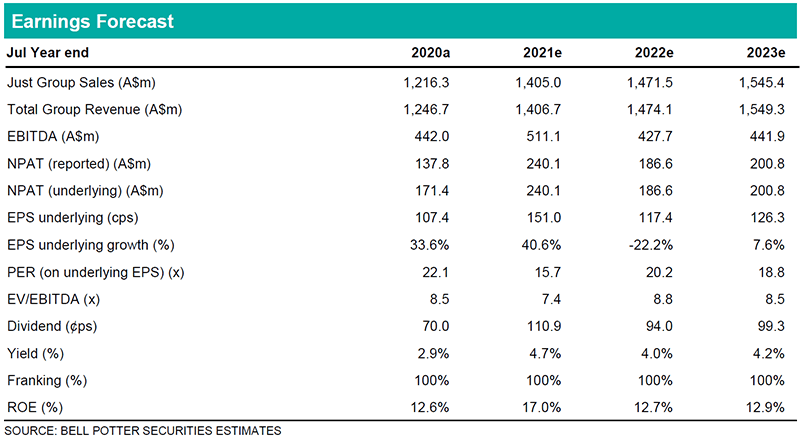

A strengthening in our FY21 margins increases our FY21 EPS by 39.5%. We have made no material forecast changes in FY22/FY23. Including time-creep, our 12-month PT increases to $23.90 (previously $22.00). On the back of PMV’s share price rally, combined with our view that current record margins and sales are not sustainable, along with some leadership uncertainties, we downgrade our rating from Buy to Hold.