Strategic acquisition

Nitro announced it has entered into a binding agreement to acquire Connective NV for an EV of €70m (~US$81m). Connective is Belgium’s leading eSign SaaS business with fast growing market share in France and customers in 11 other European countries. The rationale for the acquisition is it will accelerate and enhance Nitro’s eSign, eID (electronic identity) and document workflow capabilities. It will also position Nitro to become the third global player in the enterprise eSign market along with DocuSign and Adobe. The €70m consideration equates to a 2021 revenue multiple of 11.5x which is not dissimilar to Nitro’s multiple this year. The company expects the acquisition to generate annualised revenue synergies of US$2.5m by December 2022 – by offering Connective’s solutions to Nitro’s 12,000+ business customers – and including these synergies reduces the revenue multiple to 8.5x. The acquisition is to be funded by a fully underwritten A$140m capital raising.

Revenue upgrades

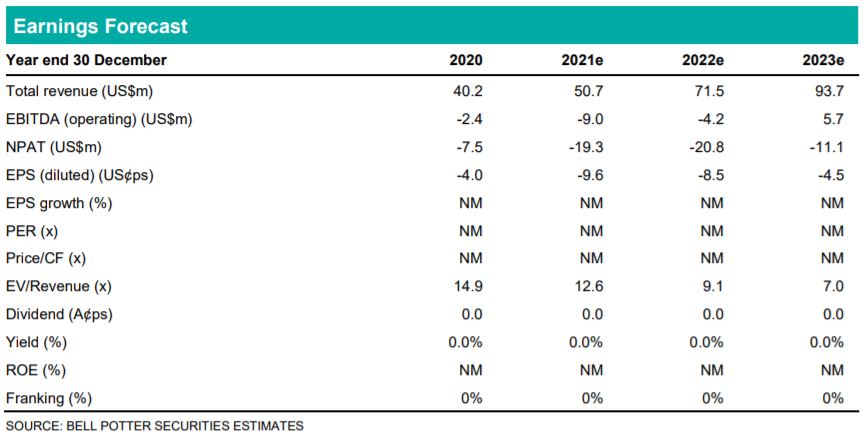

We have updated our forecasts for the acquisition and the impact is revenue upgrades in 2022 and 2023 of 13% and 16%. There is no change in our 2021 forecasts as the acquisition is only expected to be completed in late December and the company also reiterated its 2021 guidance with the announcement of the acquisition today. We have modestly increased our forecast operating EBITDA loss in 2022 but also modestly increased our forecast operating EBITDA profit in 2023 as we expect Connective to be EBITDA positive in that period.

Investment view: $4.50 PT unchanged, Maintain BUY

We have updated each valuation used in the determination of our price target for the revenue/earnings changes as well as market movements and time creep. We have also increased the premium we apply in the EV/Revenue valuation from 20% to 50% and reduced the WACC we apply in the DCF from 9.0% to 8.5%. The net result, however, is no change in our PT of $4.50 which is >15% premium to the share price so we maintain our BUY recommendation.