First tranche: US$106m placement

NIC has completed a fully underwritten Institutional Placement of US$106m (A$148m) priced at A$1.37/sh. This is the first stage of a US$225m capital raising which comprises a further US$106m non-underwritten placement to Shanghai Decent Investments (SDI) a subsidiary of Tsingshan Group, NIC’s partner at both Indonesian Morowali Industrial Park (IMIP) and Indonesia Weda Bay Industrial Park (IWIP). The raise also includes a ~US$13m (~A$18m) non-underwritten share purchase plan (SPP) for eligible shareholders. The capital raising will fund NIC’s initial acquisition of a 30% interest in the Oracle Nickel Project (ONI), located within the IMIP, for consideration of US$159m. This is part of total consideration of US$525m (incl. shareholder loans of US$154m) for a 70% interest in ONI, to be completed by Q1CY23. NIC has now completed the Stage 1 acquisition, securing 10% of ONI.

Earnings growth profile de-risked and reinforced

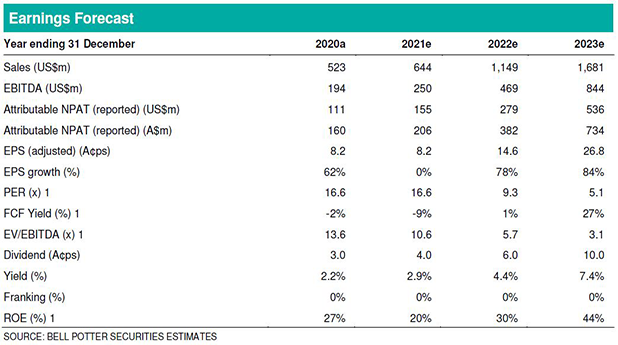

This capital raising represents a key milestone in de-risking the funding of the acquisition of the balance of the 70% ONI interest. We anticipate the balance of NIC’s consideration, which is scheduled to be completed in stages by end March CY23, will be funded by cash on hand, operating cash flows from NIC’s existing NPI and laterite ore mining operations, supplemented by corporate debt. We view the ONI acquisition as highly value accretive, highly capital efficient and locking in an aggressive production and earnings growth profile that we do not see being matched in the sector.

Investment thesis – Buy, TP$1.83/sh (from $1.89/sh)

Our EPS forecasts are lowered 9% and 8% for FY22 and FY23 respectively on a combination of financing costs associated with the funding activities and the dilution of the equity raise. We lower our FY22 and FY23 dividend forecasts, reflecting dilution, increased gearing and capital investment phase. Our NPV-based price target is lowered 3%. We continue to forecast aggressive EPS growth of 78% and 84% for FY22 and FY23, on what we view as conservative production forecasts. NIC remains one of our top picks across the sector and we retain our Buy recommendation.