Expecting $6.45bn cash earnings, 60¢ final dividend

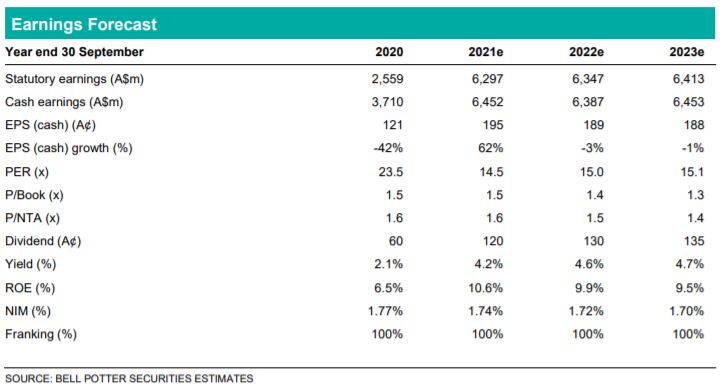

NAB will report its FY21 result on Tuesday 9 November and our forecasts include: 1) statutory earnings $6.30bn; 2) cash earnings $6.45bn; 3) cash EPS 195¢; 4) cash earnings ex-large notable items (i.e. excluding restructuring-related costs and customer-related remediation) $6.52bn; 5) cash EPS ex-large notable items 197¢; 6) fully franked final dividend 60¢; 7) ROE 10.6% (10.7% ex-large notable items); 8) NIM 1.74%; 9) credit impairment charge $0.00bn/0bp GLA; and 10) Level 2 CET1 ratio 11.7%. The performance reflected better credit impairment outcomes with ongoing momentum across home, SME and New Zealand lending. The bank still remains “optimistic about the long-term outlook for Australia and New Zealand” – still positive overall in the long run.

We don’t expect too much difference between 3Q21 and 4Q21. Cash earnings before tax and credit impairment charges should be around -1% (or +1% after them), so there is only minimal change here. This is due to a slight decline in other income but steady NIM. We also expect operating expenses to be around 1% higher (previously flat) with a mix of productivity, technology and investment spend baked into the numbers – these are in line with the target expense growth of 0-2%. While credit impairment charge was a write-back of $112m, we still think it will rise slightly and this time to around zero in FY21 (as opposed to $44m expense previously). Finally, Level 2 CET1 ratio should be around 11.7% mainly due to the $2.5bn buyback.

Price target $31.00, maintain Buy rating

There is a small change to earnings, being only 1% on the downside across the forecast horizon. On the other hand, the composite valuation has been kept the same based on improved multiples for the SOP component. As a result, NAB’s price target is unaffected at $31.00. Given a 12-month TSR of close to 15%, the bank’s Buy rating has been retained.