Better than ever

There is not much difference in the Chairman’s address, being about COVID-19 and work continues in respect of performance and future of the business. While this appears to be well progressed, the years ahead continue to have their challenges. Nevertheless, there is a strong focus on customers/colleagues and to grow the business safely. NAB is now the second largest major bank by market capitalisation. The payout ratio is now close to its maximum, being 65-75% of cash earnings. ROE was 10.7% in FY21 and still climbing, while CET1 ratio was 13% and ahead of the 10.75-11.25% target range. The bank still intends to return surplus capital, being 40% complete. The acquisition of 86 400 plus the proposed acquisition of Citigroup’s Australian consumer business will see the bank achieve scale in digital and consumer banking offerings. Likewise, change has been made as to how the bank has treated governance, accountability and culture. A number of regulatory matters have also been concluded and $1.3bn has been returned to customers. As mentioned earlier, core earnings continued to improve and there were no large one-off items. The bread and butter role of its largest division Business & Private Banking had another good year in market share, likewise Personal Banking and Corporate & Institutional although Markets remains difficult for the time being.

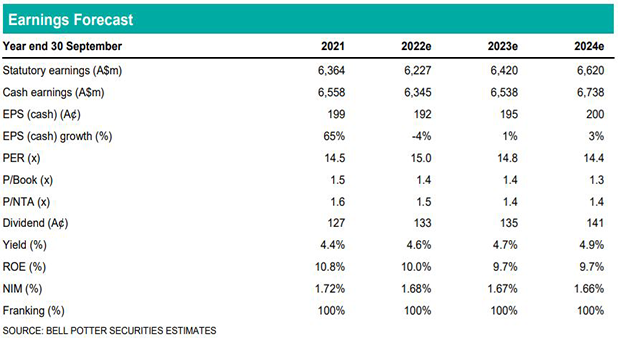

Price target increased to $32.00, Buy rating unchanged

Our FY22 and FY23 forecast earnings are slightly increased by 1%, all else being equal. We have also slightly increased NAB’s valuation by around 3% and this is mainly due to better premiums ahead in Business & Private Banking (FY22 PE 15.5x), Personal Banking (FY22 PE 14.0x) and Corporate & Institutional Banking (FY22 PE 15.0x). Based also on a PB of now 1.6x overall, we have increased NAB’s valuation and price target by 3% to $32.00 (previously $31.00). The Buy rating is unchanged.