Expecting $1.59bn cash earnings

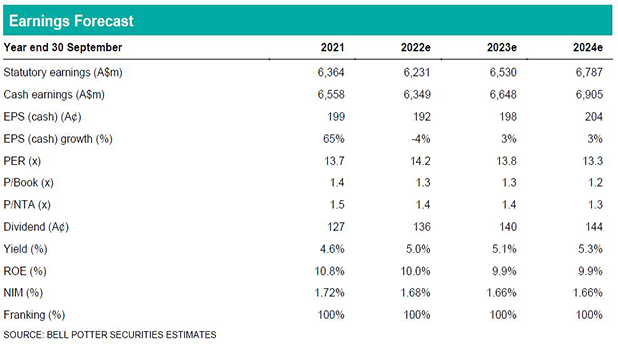

Back in FY21, cash earnings and cash EPS were $6.56bn and 199¢ and there was no difference to numbers ex-large notable items (i.e. excluding restructuring-related costs and customer-related remediation). On a quarterly basis, these would be around $1.61bn cash earnings and 49¢ cash EPS respectively and would be equivalent to our forecasts of close to $1.59bn cash earnings and around 49¢ cash EPS in 1Q22 (again with no difference to ex-large notable items).

Level 2 CET1 ratio is expected to be around 12.2% after taking into account total proceeds from the Citi acquisition (~32bp) and $2.5bn buyback (~60bp). While NAB continues to manage overall Level 2 CET1 towards 10.75-11.25%, we still think this will be more at around 11.75% in the foreseeable future. Finally, we have made immaterial changes in the credit impairment charge. This is determined by better credit impairment outcomes overall including ongoing momentum across home lending, SME lending and New Zealand. The COVID-19 outlook still calls for calm but the bank remains “optimistic about the long-term outlook for Australia and New Zealand” – something that we can still agree with.

$31.00 price target and Buy rating maintained

Our forecast cash earnings are increased by 2-3%, all else being equal. These are mainly due to higher other income by as much as 8% (but mainly fee income from Corporate and Institutional Banking and M&T). On the other hand, we have also slightly increased the risk metrics to the ones now used by ANZ: 1) discount rate to 10.00% (previously 9.75%); and 2) sustainable dividend valuation yield to 4.00% (previously 3.75%). On a net basis, there would thus be little change to NAB’s valuation – and the price target is still maintained at $31.00. The Buy rating is similarly maintained based on a 12-month Total Shareholder Return of over 15%.