September 2021 quarterly report

MIN achieved good production performance, announced commercial production from the Kemerton lithium hydroxide plant by mid-2022, and that mining would restart at the Wodgina lithium mine in Q1FY23. The price received for its Mount Marion lithium

concentrate was double the average price received in FY21. However, this was overshadowed by a large contraction in iron ore demand (MIN’s dominant revenue earning product over the last twelve months), the resulting iron ore price decrease, and increases in grade and quality discounts applied to MIN’s ~58% Fe product.

Price realisation: fines, lump and magnetite

In the last year, MIN’s existing iron ore operations were configured to maximise throughput by exporting all fines products. During the quarter, MIN made processing plant modifications to enable the flexibility to produce a proportion of lump iron ore (which attracts a price premium relative to fines). Longer term, MIN highlighted exploration work in the Yilgarn for magnetite resources, which are capable of producing ~65% Fe products.

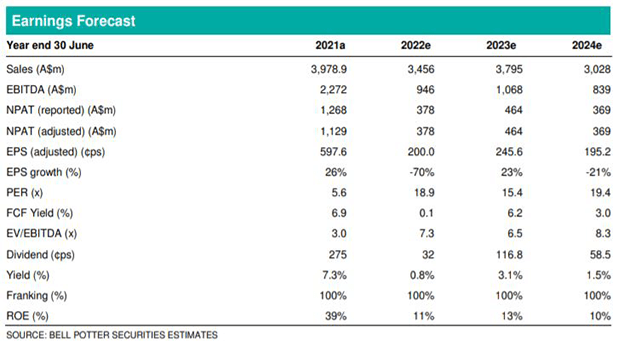

Investment thesis – Buy, Target Price $50.45/sh

We maintain our Buy recommendation for MIN in accordance with our ratings framework. We forecast further iron ore price volatility and reductions towards lower long-term levels. In the next twelve-months there are a number of catalysts for MIN’s

share price. News flow around strategically important iron ore export capacity expansions of up to 80 Mtpa in Western Australia is expected. In lithium, news is expected around downstream processing and recommencing production from Wodgina. Production testing of the Lockyer Deep 1 natural gas well is planned for Q3FY22, and further disclosures around MIN’s energy business ambitions are expected, including additional exploration activities. Changes to our earnings estimates with this update include 50%, 18% and 17% decreases to FY22e, FY23e and FY24e respectively, resulting primarily from our changes to our forecast commodity prices and our forecast iron ore quality discounts.