Looks cheap relative to reasonable comp

Last week a reasonable comp for Life360, Nextdoor, listed on the NYSE and was up around 30% on its first day of trading then held that gain over the week. The company also released its Q3 results and upgraded its 2021 guidance to revenue b/w US$185- 188m (previous guidance US$181m) and adjusted EBITDA US$(47-48m) (previous guidance US$(49m). The stock is now trading on an EV/Revenue multiple of c.23x based on the mid-point of the upgraded 2021 guidance and this compares to a multiple of c.13x for Life360 based on our 2021 revenue forecast of US$111m (which is around consensus). The multiple of Nextdoor is therefore significantly higher than that of Life360 even though, in our view, Life360 is a higher quality company given it generates most of its revenue through subscription whereas Nextdoor generates most of its revenue through advertising. The multiple of Nextdoor therefore makes Life360 look cheap and is relevant given Life360 is planning a secondary listing in the US sometime next calendar year.

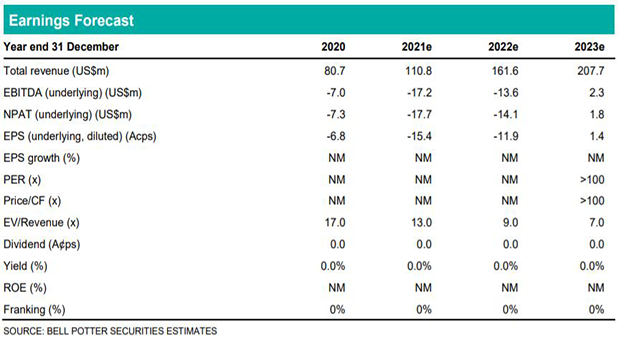

No change in forecasts

There is no change in our forecasts which we only recently updated on the back of the release of the quarterly released late last month. We continue to forecast 2021 and 2022 revenue of c.US$111m and US$162m which is around consensus if not a little below. Our forecasts assume no further acquisitions though we continue to believe another is likely in the short term and will be more material than the last (Jiobit).

Investment view: PT up 18% to $14.75, Maintain BUY

While there is no change in our forecasts we have updated each valuation used in the determination of our price target for market movements and time creep. Given the successful listing of Nextdoor we have also increased the premium we apply in the relative valuations from 25% to 50% and reduced the WACC we apply in the DCF from 8.6% to 8.4%. We have also increased the weighting of the EV/Revenue valuation in the calculation of the PT. The net result is an 18% increase in the PT to $14.75 which is >15% premium to the share price and we maintain our BUY recommendation.