ANZ leads in 1Q22, UK step change expected from 2Q22

LBY made solid progress during 1Q22, reporting record Group Gross Merchant Value (GMV) of NZ$184m, up +58% YoY (annualising NZ$738m). The ANZ division achieved record GMV of NZ$88.2m, with the UK up 101% YoY to NZ$95.8m. UK customer growth continues to lead ANZ, which remains key for LBY as it continues to build scale, and ANZ saw strong new Merchant growth during the quarter. LBY remained well capitalised with a cash balance of NZ$36.5m.

Is LBY the most undervalued BNPL player?

In this report (page.4) we highlight that LBY is trading at a significant discount to its BNPL peers on both a Market Capitalisation to GMV and Active customer basis. LBY is a market leader in both the UK (No.3) and NZ, which represent strategic value, and we see increasing potential for the company to become a target for M&A activity.

UK retail spend represents ~2.0x that of Australia, and the market remains within relative infancy in the adoption of BNPL products compared to both Australian & the US. We see LBY’s focus within this market as a differentiating factor within the BNPL market. LBY has positioned itself to deliver strong UK GMV & revenue growth in FY22 through recent partnerships with Rakuten Awin & Sovrn (which should drive higher engagement through access to ~5,000 merchants within the Laybuy App), this couples with the recent A$40m capital raising to support this growth runway.

Investment View: Buy (Spec) retained, Valuation A$1.20ps

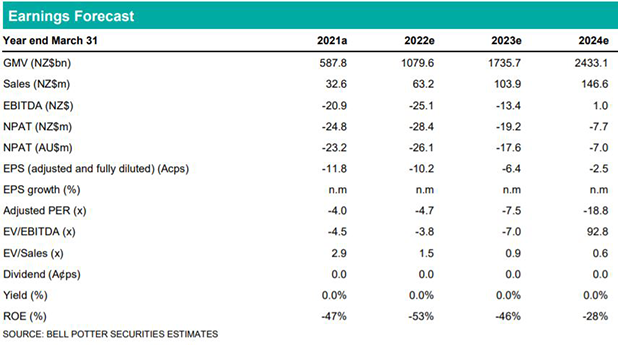

We reinstate our Buy (speculative) recommendation on LBY with the company on track to achieve guidance to exceed NZ$1.0bn of GMV, and deliver 90%-100% revenue growth in FY22. At current levels we increasingly believe LBY’s differentiated positon within the BNPL sector remains overlooked by the market and should begin to re-rate as the company continues to hit key milestones. Updating our forecasts following LBY’s FY21 and 1Q22 updates, along with LBY’s equity raising in May’21, we adjust our underlying EPS estimates by -4.1cps, -4.0cps and +0.5cps for FY22-FY24 respectively and reinstate coverage with a Valuation of A$1.20ps.