7% beat at underlying EBITDA

1HFY25 revenue of $510m was 3% below our forecast of $524m but underlying EBITDA of $74.1m was 7% above our forecast of $69.5m. The beat was obviously driven by a much higher underlying EBITDA margin than forecast (14.5% vs BPe 13.3%). There was a bigger beat of 16% at underlying NPAT ($29.3m vs BPe $25.2m) which was also driven by lower D&A than forecast ($22.6m vs BPe $24.1m). Cash flow was good with operating CF to EBITDA of 92% (vs 84% in pcp) and net debt reduced to $121m at 31 Dec vs $131m at 30 Jun. The interim dividend of 9.5c ff was in line with our forecast.

Soft upgrade to FY25 guidance

IVE revised its FY25 guidance from underlying NPAT of $45-50m to $47-50m. The company still expects Lasoo to generate an operating loss similar to FY24 but restructuring costs are now expected to be $3.5m vs $2.5m previously. The level of capex has also been increased from $24.5m to $32m due to an acceleration of the packaging capacity build-out.

Low to mid single digit earnings upgrades

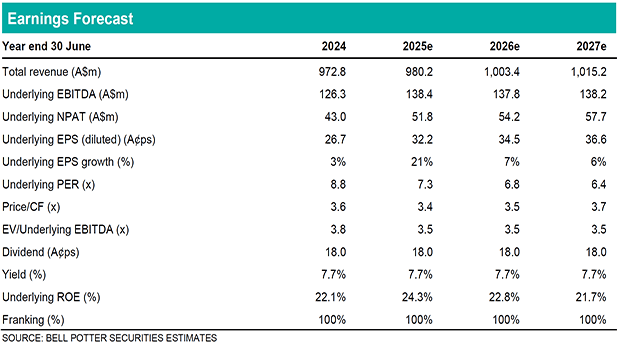

We have downgraded our revenue forecasts by 3% in each of FY25, FY26 and FY27 but have conversely upgraded our underlying EBITDA forecasts by 3%, 2% and 2%. The upgrades at underlying NPAT are greater – 6%, 5% and 6% – and we now forecast FY25 underlying NPAT of $51.8m which is above the $47-50m guidance range.

Investment view: PT up 4% to $2.80, Maintain BUY

We have rolled forward our PE ratio and EV/EBITDA valuations by a year and apply similar multiples of 7.5x and 4.0x to our FY26 forecasts. We have also increased the WACC we apply in the DCF from 9.4% to 9.8% due to an increase in the risk-free rate. The net result is a 4% increase in our PT to $2.80 which is >15% premium to the share price and we maintain the BUY. A potential catalyst is the strategy update in late Q4.