Feed falling

ING’s share price has remained fairly depressed post-1H24 despite the continued downdraft in both domestic wheat and imported soybean pricing. Key points:

Feed costs: Since reporting Australian ASW benchmark wheat and soybean meal prices have fallen ~5%. Given ING’s forward purchasing arrangements, we see CY24TD feed cost indicators (drives FY25e COGS) down -13% relative implied FY24e levels, with our spot feed index -19% below the implied FY24e average. While our forecasts already assume a downdraft in FY25e feed COGS, the current implication if sustained is a more material downdraft than allowed for in our forecasts.

Pricing has looked reasonable: CPI indicators for Feb’24 in NZ demonstrated MOM gains of +1% and while down -1% YOY looks reasonable. CPI indicators for Australia in Jan’24 continued to demonstrate upward inflation, up +1% MOM and +3% YOY. Inflation data has so far supported outlook comments from ING at the 1H24 result.

Bostock acquisition: ING recently announced the acquisition of NZ organic poultry producer Bostock Bros. for NZ$35.3m (or 8.8-10.1x PF24 EBITDA). The acquisition is expected to be immediately EPS accretive to FY25e and including identified synergies is expected to generate a ROIC materially in excess of ING’s hurdle.

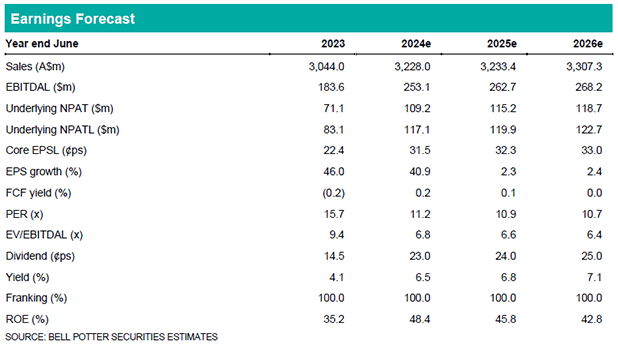

We have incorporated the acquisition of Bostock Bros in our forecasts resulting in NPAT upgrades of +1% in FY25e and +1% in FY26e. Our target price is unchanged at $4.35ps. Our forecasts currently incorporate ~9% YOY compression in feed costs in FY25e and no material change in FY26e. The YTD/Spot implication is a more material downdraft than allowed for, implying a potential profit pool is emerging.

Investment view: Buy rating unchanged

Our Buy rating remains unchanged. Feed cost drivers have weakened materially in CY24 and this is likely to manifest in COGS in FY25e. The upside from lower feed costs in our view mitigates the ongoing risk of channel shifts. Trading at the lower bound of its historical EV/EBITDAL trading range and well below its historical average (of 8.3x EV/EBITDAL) we retain our Buy rating.