The Infomedia share price has materially fallen since the release of the 1HFY21 result about a week-and-a-half ago and in our view this has been driven by: 1. A slightly weaker-than-expected result and outlook for the second half; and 2. The lack of any acquisition and the unlikelihood of one occurring in the near term. We believe the share price reaction is overdone, however, as: 1. The 1HFY21 result showed the company is performing well despite the challenging operating environment and is well positioned with its Next Gen SaaS platform; and 2. There is a reasonable likelihood of one or more acquisitions in the next six to twelve months. We also note the Balance Sheet is very strong with a net cash position of c.$93m at 31 December though admittedly the raising of around ten months ago which contributed to this strong financial position is also having a dilution impact on the forecast EPS.

No change in forecasts

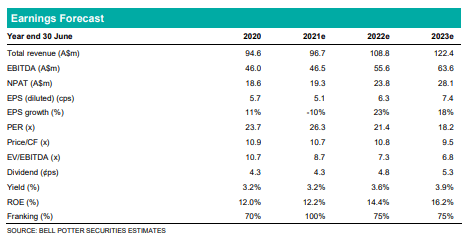

There is no change in our forecasts which we only updated recently with the release of the 1HFY21 late last month. We continue to forecast a similar though slightly better 2HFY21 result relative to 1HFY21 and we assume no acquisitions this half. We then forecast strong double digit EPS growth in both FY22 and FY23 and this is driven by a mix of organic growth and one or more acquisitions in each period. Our forecasts assume acquisitions totalling $25m in each of FY22 and FY23 which contribute several million dollars revenue each year and are EPS accretive.

Investment view: $1.75 PT unchanged, Upgrade to BUY

While there is no change in our forecasts we have updated each valuation used in the determination of our price target for recent market movements. There is no change in the 25% discount we apply in the relative valuations but we have reduced the WACC we apply in the DCF from 10.2% to 9.9% given the strong operational performance in 1HFY21 and also the likely discipline being applied to potential acquisitions. The net result, however, is no change in our PT of $1.75 which is a 30% premium to the share price so we upgrade our recommendation from HOLD to BUY.