Some beats in 1H25 and good momentum at the start of 2H

Harvey Norman (HVN)’s 1H25 result saw some beats in the Australian Franchising division and also in the company operated New Zealand region. Australia franchisee headline comparable sales growth strengthened to +8.6% on pcp in Nov-Dec from +3.1% on pcp in Jul-Oct while all regions except Singapore/Malaysia had an incrementally better start to 2H with the positive consumer uptake of Mobile, Computer Technology and Home Appliances categories. In terms of new store growth, company-operated overseas stores were at 122 with 5 new stores opened across NZ, Malaysia & UK (Merry Hill flagship store) and 1 closure in Singapore.

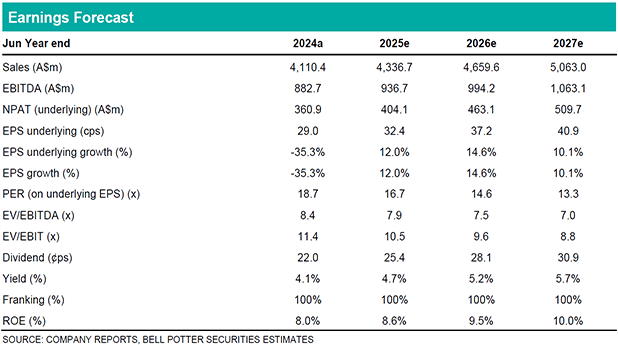

Earnings changes

We factor in the beats in Australian franchising/NZ however somewhat offset by misses in Asia and higher costs (than BPe) in the company operated division including that for the UK flagship (opened in Oct-24). Our revenues are upgraded with the current comparable sales growth at +2.1% for Jan and +7.0% for Feb (first 21 days) in Australia while NZ has improved to better than expected -1.0% for Jan. We also make some changes to our new store assumptions given the closures of smaller stores in NZ (however offset by larger openings) and longer dated Malaysian store growth outlook. The net result sees our NPAT forecasts -1.8%/+2.3%/+3.1% for FY25/26/27e.

Investment View: PT +3% to $6.00, maintain BUY

Our PT +3% to $6.00 with earnings/cash flow changes. Our PT is based on a sum-of-the-parts valuation with a DCF methodology (WACC ~9%, TGR ~3%) for retail operations (ex-Property) and the property bank on a fair value basis (as last reported) assuming a broadly stable capitalisation rate in FY25e and ahead. We see HVN trading attractively at ~15x on a 1-year forward basis with multiple catalysts near/midterm such as improving sales trends in key markets assisted by a sizable upside from the AI driven upgrade cycle/replacement & spend shift to tech, gaining penetration in targeted regions in the UK in addition to the incremental earnings opportunities in its Property division as Australia’s largest single owner with a $4.4b global portfolio.