FY21 financial result

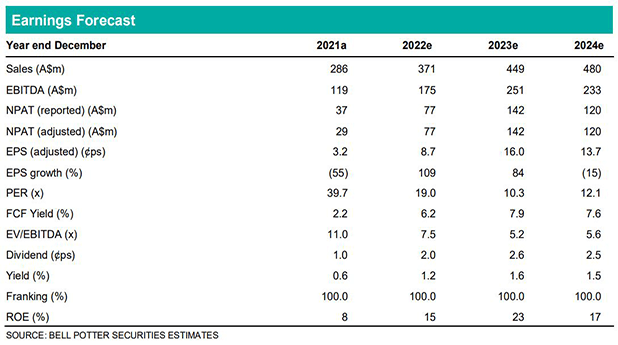

GOR reported revenue of $286m (vs BPe $281m), EBITDA of $119m (vs BPe $116m) and NPAT of $36.8m (vs BPe $42.3m). The result was in-line with our expectations for a slightly weaker financial performance, with the main differences being depreciation $60.2m (vs BPe $45.8m), and its effect on tax expensed. EBITDA dropped 70% and earnings dropped by 46% vs the pcp on lower production and higher costs, the result of previously reported processing maintenance issues and lower than average Ore Reserve gold grades. A fully franked dividend of 0.5 cents per share was declared for the 2HCY21. At the end of CY21 GOR held cash of A$131.5m and no drawn debt.

Looking ahead to CY22

The midpoint of the CY22 guidance range (320 koz) represents a 30% increase in gold production over the CY21 result (246.5 koz), and will require improved performance in both processing plant availability and Ore Reserve gold grade reconciliation.

Investment thesis: Hold (from Buy), TP$1.70/sh (unchanged)

GOR’s share price has appreciated significantly since the beginning of February ($1.33/sh), exceeding our price target, and reaching $1.835/sh in March. We consider that share price appreciation is mainly due to external macro factors that have benefited most Australian gold producers, with the S&P ASX Gold Index up +20% and the US$ gold price up ~7% over this period. Supportive macro factors include rising inflation and increased geopolitical risks driving the safe-haven trade in a period of broader market volatility. In accordance with our rating structure and forecast TSR of 3.9%, we lower our recommendation to Hold. EPS changes in this report are: CY22 – 16%; CY23 +3%; and CY24 +5%. This is driven by updated corporate cost and depreciation allowances.