Mining impacted by labour availability

GOR reported that Gruyere gold production was lower qoq due to labour availability issues impacting mining performance. Gruyere produced 74.6koz of gold vs BPe 88koz (100% basis, 50% GOR). All-In-Sustaining-Costs (AISC) will be reported with the 4QCY23 report. Gruyere ore tonnes processed (on a 100% basis) totalled 2.2Mt at 1.1 g/t Au, with a recovery of 93.1% (vs BPe 2.3Mt at 1.30g/t Au, and a recovery of 91.5%). GOR sold 37koz at A$3,040/oz (vs BPe 44koz at $3,077/oz). The company ended the quarter with cash and equivalents of A$149.8m, down from A$209.3m in the previous quarter, following the De Grey Mining Ltd (DEG, Spec. Buy, $1.90/sh) capital raising and the payment of dividends (totalling $74.2m). CY23 gold production totalled 322koz and met the lower end of annual production guidance of 320koz-to-350koz.

Changes to our forecasts

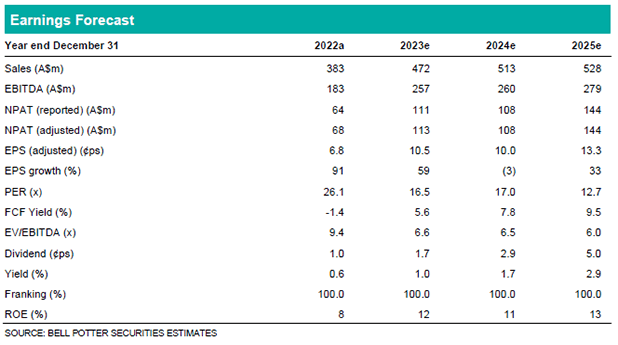

We update our model for: i) the 4QCY23 production update, ii) mark-to-market valuations for GOR’s listed investments, iii) reduce our forecast production for CY24 (-5%) and CY25 (-7%) to reflect a slower ramp up of processing to 10Mtpa of ore, which we now forecast in CY26, and iv) increased forecast mining costs in CY24.

Investment view: Buy, TP$2.05/sh (from $2.10/sh)

We reduce our TP by 2.4% due to changes to our forecast production. With a TSR of 21.9%, we maintain our Buy recommendation. After reaching a high of $2.04/sh in December on high spot gold prices, GOR sold off with the 4QCY23 production update. At Gruyere, GOR is in the process of commissioning an expanded mining fleet, and crushing upgrades. Key near-term catalysts for GOR will be how these upgrades flow through to CY24 guidance (expected late January 2024) and subsequent production. We expect the upgrades will enable continued production growth through CY24 and CY25, which we forecast will be supported by a strong gold price environment. GOR owns 19.9% of DEG. CY24 will be an important year for development of DEG’s Hemi Gold Project, where it is targeting project construction commencement for late in the year. EPS changes with this update are: CY23: -11%, CY24 -23%, CY25 -14%.