Livestock markets take the edge off

At a very high level we see conditions in general more favourable for ELD in the months following the FY23 result, with improved rainfall patterns in key cropping areas and stronger livestock pricing trends with continued YOY gains in volumes.

Livestock markets: Recent rainfall has seen a rapid acceleration in livestock prices, with the EYCI up >50%, heavy steer pricing up >40%, Mutton up >150% and trade lamb up >50% since ELD reported in Nov’23. In addition, both saleyard and slaughter volumes continue to demonstrate robust YOY gains in both cattle and ovine markets.

Summer cropping: Rainfall post the FY23 result has generally been supportive of an improved outlook over the summer crop acreage, with vastly improved soil moisture profiles in key cropping areas. We would expect the demand outlook for inputs into the summer crop would be stronger than it was at the time of the FY23 result.

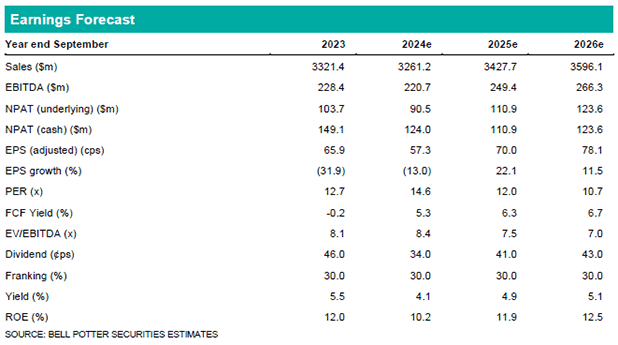

SYSMOD costs: ELD’s recent investor day highlighted more detail on the system modernisation program, upon which it expects to generate a >15% ROIC on its investment. In the near term we expect a higher level of ongoing cost incursion from FY24e and have adjusted our forecasts to reflect this. We have adjusted our forecasts to incorporate a stronger outlook in livestock markets softened in part by higher assumed opex costs related to SYSMOD and slighter lower fertiliser prices. The net effect is NPAT changes of +9% in FY24e, -1% in FY25e and +2% in FY26e. Our target price is raised to $9.50ps (prev. $8.35ps) following these changes.

Investment view: Buy rating unchanged

Our Buy rating is unchanged. Since reporting FY23 results in Nov’23 soil moisture profiles in key summer cropping regions have improved (with NOAA long range forecasts shifting to ENSO neutral by April-June) and livestock prices have firmed, with volumes generally continuing to demonstrate high single-to-double digit YOY gains in both cattle and sheep/lamb markets.