Global Property Securities (G-REITs)

Just as diversification through global equities and bonds is a prudent approach for more conservative investors, we believe that deepening this spectrum to include global real estate securities may enhance risk-adjusted returns, minimise volatility due to the lower correlations with other asset classes, and create a yield uplift on the aggregate portfolio level.

Real Estate Investment Trusts (REITs) were first structured in the United States in 1960 by Congress to facilitate and democratise investment in large-scale, diversified portfolios of income-producing real estate or real estate-related assets, in a tax-advantaged structure.

According to the United States Securities and Exchange Commission, a REIT is defined as a corporation which operationally derives income and capital growth through a professionally managed investment portfolio of real estate assets. To additionally qualify as a REIT, a company must also distribute at least 90% of its taxable income to shareholders annually in the form of dividends. This rate was reduced from 95% in 2001. The payout ratio functions as a special tax deduction, with REITs that elect to pay out the entirety of taxable income therefore owing nil corporate tax.

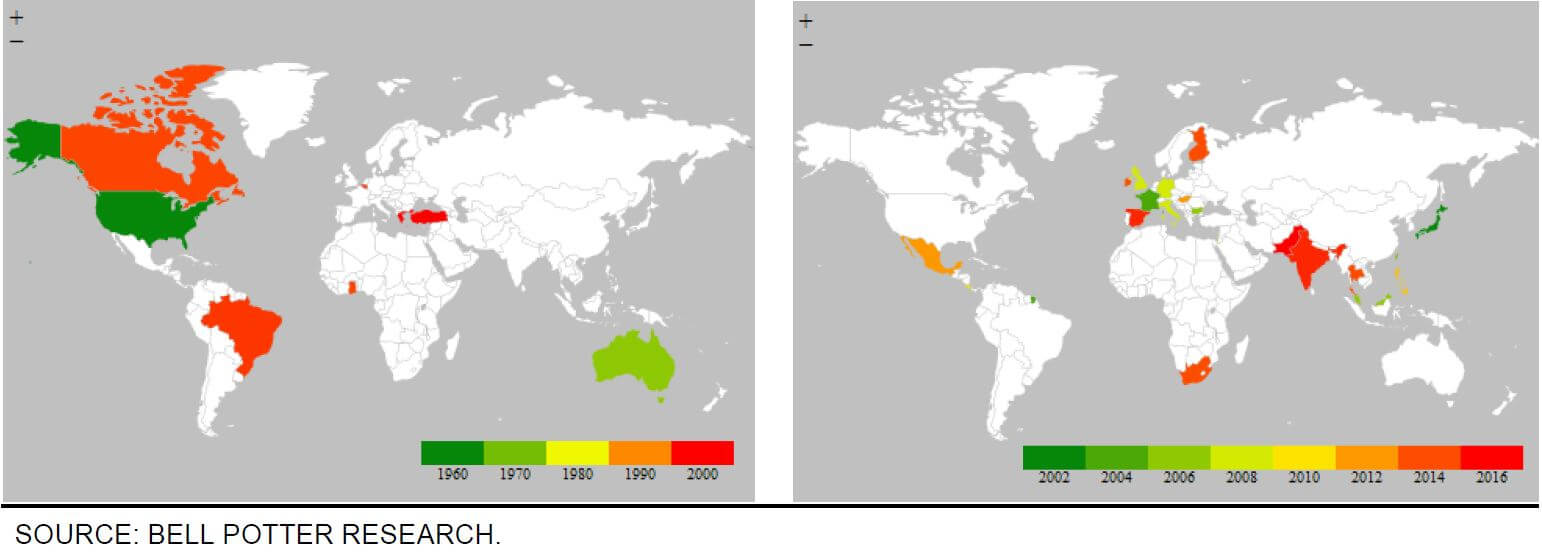

Globally REITs have lower penetration and development outside of Australia, the United States and the Netherlands, where legislative codification occurred during the 60s and 70s. Regulatory approval is however, now spreading worldwide and investors should capitalise on the fact.

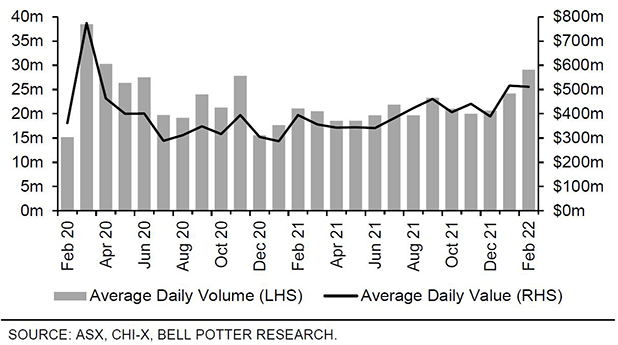

Figure 1 – Penetration and acceleration of the REIT market

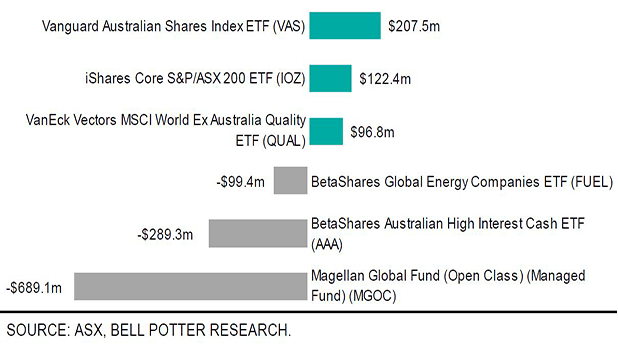

Figure 2 – Top ETF flows for February 2022

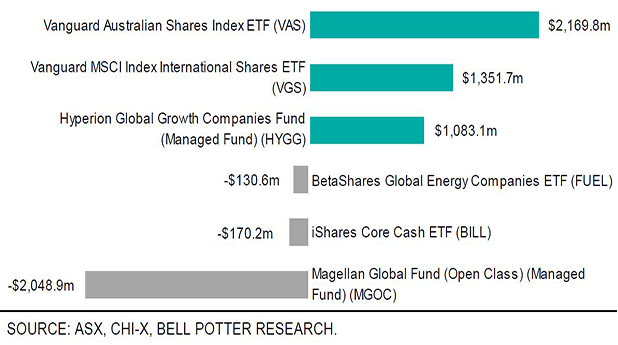

Figure 3 – Top ETF flows for 12 months ending February 2022

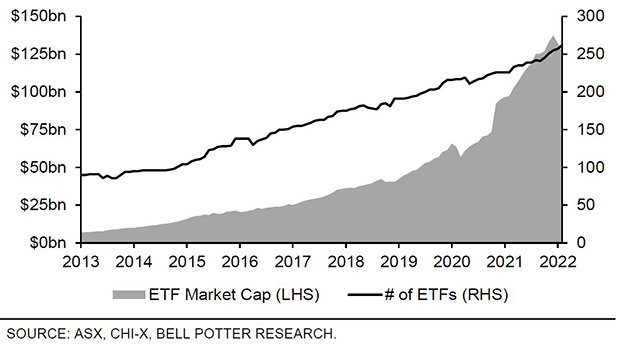

Figure 4 – ETF market size

Figure 5 – Average daily volume and value