Iron ore price continues to enhance dividend expectations

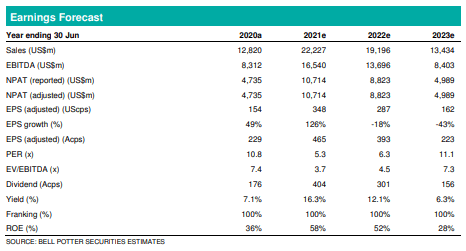

The extraordinary iron ore price action we have continued to see through the June quarter has prompted us to further refine our financial performance forecasts for FMG as we head towards the end of FY21. Marking-to-market the iron ore price for the June 2021 quarter to date shows the average price now sits at ~US$184/dmt. This compares with our previous forecast of US$160/dmt and the current spot price of US$212.90/dmt (source: Metal Bulletin/Fastmarkets). This lifts our 2HFY21 forecast to US$179/t, up 9% from US$164/dmt previously. Our higher forecast iron ore price flows through to modest earnings and dividend increases. It is partially offset by a higher AUD:USD forecast and the slightly higher costs reported in the March 2021 quarterly. Our FY21 dividend increases 4% to A404cps, inclusive of a fully franked final dividend payment of A257cps (from A241cps), a 10.4% yield on its own.

FY21 upside relatively capped from here

We have also considered a scenario of the current spot price being maintained. Rolling the current spot price of US$212.9/dmt forward over the balance of the June quarter results in an average iron ore price of US$200.50/dmt for the quarter and an average of US 184.0/dmt for 2HFY21. While this scenario results in an improved performance for FMG it shows that the benefits are limited, with metrics improving just ~1% across FY21 compared to our latest base case. This includes a final FY21 dividend payment of A262cps, just A5cps (1.9%) higher than our base case. It implies that upside to our latest forecasts are, to a degree, capped and that even with positive price volatility the range of FMG’s key performance metrics are narrowing and, in our view, priced in.

Investment thesis – Hold TP$23.96/sh (from Buy, $23.85/sh)

Our NPV-based target price increases incrementally to $23.96/sh and our FY21 and FY22 earnings forecasts increase 4% and 7% respectively on this update. While the dividend remains a compelling price support, recent share price appreciation has reduced our forecast total shareholder return to 14.2% and we lower our recommendation from Buy to Hold, in conformity with our recommendation structure.