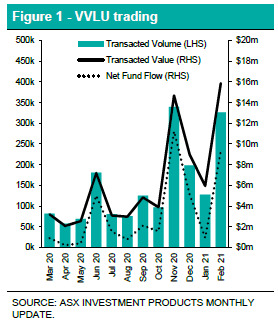

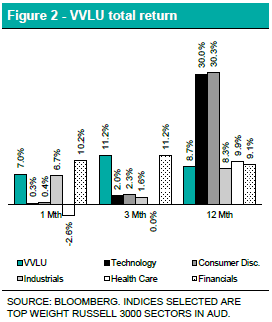

Volumes in the Vanguard Global Value Equity Active ETF (VVLU) are on the rise coinciding with the re-opening of global economies, positive GDP growth and prospects of a reflation trade. During the month of February, VVLU experienced significantly larger net fund flows of $9.3m, pushing the number of units outstanding up by 15.6% to 1.4m, with FUM at $68.8m. A similar reactive spike in in trading behaviour was also witnessed back in November 2020, after joint news of Oxford-AstraZeneca and Pfizer-BioNTech COVID-19 vaccines were found to be grossly efficacious. February results out of Israel found unequivocally a 94% drop in symptomatic COVID-19 infections among the 600,000 people who received two doses of the Pfizer’s vaccine. Vanguard’s quantitative model implements an active approach that aims to assess the factor exposures of global securities, favouring equities with relatively lower fundamentals than peers. The fund recorded a P/E of 13.8x, compared to 24.4x for the benchmark Russell 3000 Index.

Authored by Hayden Nicholson, ETF / LIC Specialist at Bell Potter Securities, 26 March 2021