Leading player in counter-drone

DroneShield Limited (DRO) is an Australian defence manufacturer specialising in counter-drone technology. DRO provides an end to-end counter-drone solution that integrates proprietary artificial intelligence software with a suite of hardware products utilised to detect, identify and defeat aerial, ground and maritime threats. The company’s products are largely in-house technology and include handheld, vehicular and fixed installations. DRO’s customers primarily include military and intelligence, as well as law enforcement, critical infrastructure and commercial parties globally.

Opportunity for expansion into adjacent markets

DRO has developed advanced AI/ML capabilities in-house stemming from its experience in counter-drone and on-going R&D with the Australian DoD. The company now has the opportunity to expand outside its core business into the Electronic Warfare market, utilising its AI/ML technologies to detect and process complex signals on the electromagnetic spectrum. DRO’s appointment to the ISREW Panel and its ongoing R&D contracts are a strong endorsement of its capabilities in this field and raise the prospect of future revenue streams outside its core competencies.

Investment View: Initiate with Buy, Price Target $0.24

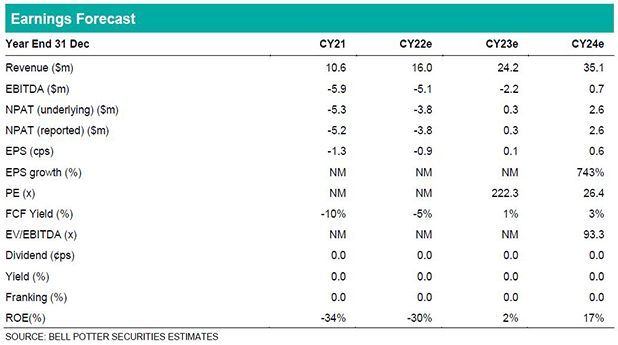

In our view, DRO is well placed to capitalise on favourable macroeconomic conditions accelerating structural growth in the market, with the strong sales pipeline (~$100m CY22, ~$250m CY23 onwards) identified by the company demonstrating long term demand. The conversion rates we apply to the sales pipeline are intentionally conservative, leaving potential upside risk to our revenue forecasts. Potential catalysts include validation of the sales pipeline through consistent contract wins and greater visibility over the pipeline through CY23 and beyond.

We initiate coverage of DRO with a BUY recommendation and a 12 month price target of $0.24. The price target is a 50/50 blend of the DCF and relative valuation methods, resulting in a 46.0% premium to the current share price.