Multiple Growth Catalysts

DOC is expected to report 3Q21 revenues and cash flows next week. The company generated significant news flow during the quarter including expansion of its virtual GP Service into the Republic of Ireland and the acquisition of GP2U in Australia. Both are expected to make modest contributions to revenue growth in the quarter.

The most significant driver of revenue growth will continue to be the core business in the UK. All COVID related restrictions finished in the UK in early July, hence this quarterly result will provide the first real insight into the sustainability of demand for the telehealth service in a post COVID environment. We are virtually certain that demand levels will continue to grow as wait times for GP’s in the UK NHS are as long as ever.

The UK Government has now completed the heavy lifting for the COVID vaccine program, consequently the availability of GP’s for telehealth service providers including DOC is likely to have improved markedly. 2Q21 revenue growth was constrained as the company struggled to find sufficient GP’s to meet demand. For the moment at least, patient demand is not the issue. The company has guided to a significant increase in capacity for consultations with up to 100 GP’s joining as consultants and capacity increasing to 45,000 consultations per month by the end of the September quarter (from approximately 30,000). This additional capacity will obviously support the markets expectations for revenue growth as well as improving gross margin.

Investment View: Maintain Buy, PT reduced to $1.30

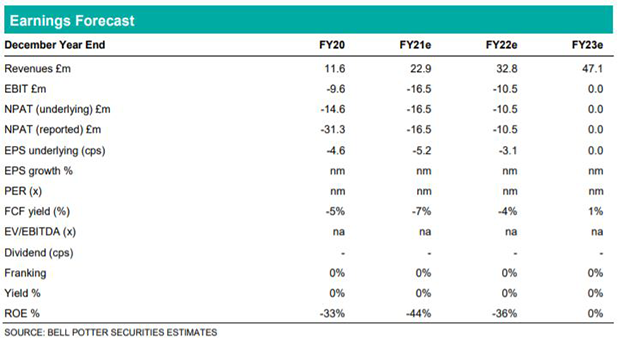

Changes to earnings are not material, however, the segment has experienced an unfavourable de-rating in recent months. This de-rating includes larger offshore peers in the US – namely Teldoc (TDOC). This de-rating has caused a review of the price target calculation resulting in a 13% reduction from $1.50 to $1.30. We retain our Buy rating.