Investing in maturing acreage

CGC have announced a material investment in citrus properties and updated CY21e earnings guidance. Main highlights below:

Acquisition: CGC is to acquire the assets of 2PH farms, a 1,474Ha citrus plantation in Northern QLD, with a further 210Ha being planted over CY21-22e. The cost is ~$231m (+$19m in transaction fees), with $200m paid upfront and a further $31m due Jul’23 for the 210Ha to be planted in CY21-22e (and subject to conditions). Production on the existing orchards is forecast at ~30kt in CY21e, lifting to ~60kt by CY25e as orchards mature (63% yet to reach maturity). This excludes volumes from new plantings.

Funding and accretion: On a ProForma CY21e basis, 2PH is estimated to contribute $29m EBITDAS. The initial cash consideration is to be funded by a $190m renounceable entitlement offer and existing debt facilities. The transaction expected to result in ProForma CY21e EPS accretion of ~10%.

Earnings guidance (pre-acquisition): 1H21e EBITDAS guidance is $124m (vs. BPe $120m), slightly more positive than May’21 guidance and reflective of an earlier citrus harvest. CY21e NPATS is expected to be marginally ahead of CY20 of $55m (vs BPe $61m) excluding the 2PH acquisition. CY21e guidance reflects ongoing weakness in avocado pricing, stable YOY export citrus pricing and lower Arana yields.

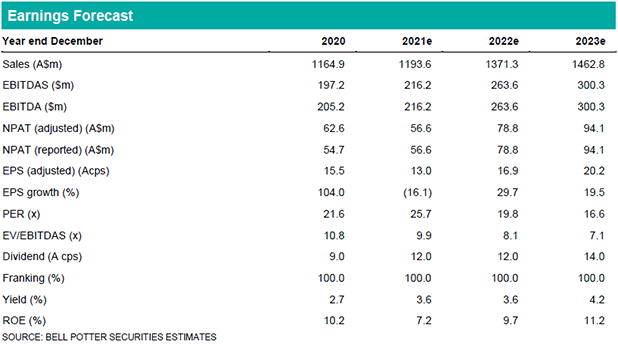

We have updated our forecasts to include updated earnings guidance, the acquisition of 2PH and associated equity funding. The net impact is an EPS downgrade of -14% in CY21e, unchanged in CY22e, and upgrade of +13% in CY23e. Our target price falls to $4.30ps (prev. $4.60s) reflecting lower avocado earnings and dilution from the equity raising, offset in large by 2PH earnings.

Investment view: Buy rating retained

There is no change to our Buy rating. During CY21e, CGC has announced ~$273m of investments in maturing citrus orchards, which together with previous investments in mushrooms, tomatoes and International blueberries is creating an attractive tail of volume and profit growth through to CY25e.