All my eggs in one basket

On June 16th the yield on 10-Year US Treasury Notes was higher at ~1.6% after the Federal Reserve signposted a rise in interest rates next year with two increases pencilled in by 2023. The announcement coincided with an upwards revision to the central bank’s inflation and economic growth forecasts. Given the developments, we consider it pertinent to reassess the possible effects of higher yields on the global stock market.

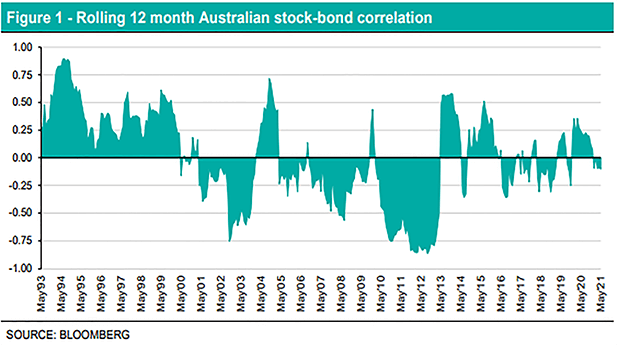

Following the assumptions of Henry Markowitz’s Modern Portfolio Theory, market participants can reduce unsystematic or specific risks by combining a number of risky assets, and without compromising on investment returns, provided that these returns are not positively correlated. While the correlation between stock and bond prices is a crucial element in the process of portfolio optimisation, the traditional model assumes a stagnant relationship, however historical data over longer periods of time may suggest otherwise (see Figure 1) (continued on pages 2 & 3).